Risk Management in Stock Market Investing

Introduction

Risk management in stock market investing involves strategies and techniques to minimize potential losses while maximizing returns. It’s essentially a safety net—a set of practices that investors use to navigate the unpredictable nature of the market. Rather than eliminating risk (which is impossible in investing), it focuses on controlling, mitigating, and managing risks intelligently.

Importance of Effective Risk Management

Understanding and implementing effective risk management strategies are crucial for any investor, especially beginners or those unfamiliar with its significance. Without adequate risk management, investors expose themselves to the full brunt of market volatility, increasing the likelihood of substantial financial losses. It’s like driving a car without a seatbelt—it’s risky, and the consequences can be severe. By acknowledging the importance of risk management, investors can safeguard their portfolios and make more informed decisions.

Types of Risks in Stock Market Investing

Understanding different types of risks lays the groundwork for effective risk management strategies, helping investors make calculated choices in their investment journey.

1. Market Risk

Market risk is the overall risk associated with the stock market’s movements. It encompasses the fluctuations in stock prices due to various factors such as economic conditions, interest rates, or geopolitical events. Market volatility, reflected in rapid price changes, can significantly impact investments. Understanding and preparing for these fluctuations is critical to managing this risk.

2. Systematic vs. Unsystematic Risk

Systematic risk refers to risks inherent in the entire market, affecting all investments to some extent. On the other hand, unsystematic risk is specific to individual assets or sectors, such as company-specific issues or industry-related challenges. Diversification helps address unsystematic risks by spreading investments across different assets.

| Aspect | Systematic Risk | Unsystematic Risk |

|---|---|---|

| Definition | Market-wide or macroeconomic risk affecting all assets. | Specific to individual assets or particular sectors. |

| Nature | Cannot be diversified away through portfolio allocation. | Can be mitigated through diversification strategies. |

| Causes | Economic factors like inflation, interest rates, etc. | Company-specific events like management changes, etc. |

| Impact | Affects the entire market or a wide segment of it. | Affects specific companies, industries, or sectors. |

| Examples | Interest rate changes, recessions, global events. | Company bankruptcy, product recalls, lawsuits, etc. |

| Management | Cannot be eliminated but managed through hedging. | Reduced through diversification across assets/sectors. |

| External Influences | Influenced by macroeconomic trends and global factors. | Influenced by internal company or industry-specific issues. |

3. Political and Economic Risks

Political and economic events often create ripples in the stock market. Changes in government policies, geopolitical tensions, or economic downturns can significantly impact stock prices. Grasping the potential risks and their impact on investments is essential to make informed decisions in a volatile market.

The Role of Diversification

Diversification is a cornerstone risk management strategy in stock market investing. It involves spreading investments across different assets, industries, or sectors to minimize the impact of any single investment’s performance on the overall portfolio. Diversification aims to reduce the unsystematic risk associated with specific companies or industries by not putting all eggs in one basket.

- Portfolio Diversification Techniques: Portfolio diversification encompasses dividing investments among asset classes like stocks, bonds, real estate, and commodities. Distributing investments among various asset classes can help balance risks and returns. For instance, bonds might offer stability when stocks perform poorly, reducing the overall portfolio risk.

- Sector Diversification and its Impact: Sector diversification involves investing in different industries or sectors, such as technology, healthcare, finance, and consumer goods. By diversifying across sectors, investors can mitigate risks associated with sector-specific events. For instance, investments in other thriving sectors can offset potential losses if one industry faces a downturn.

Diversification doesn’t guarantee profits or eliminate risks, but it does help manage and reduce the impact of unforeseen events. It’s a fundamental principle that empowers investors to navigate market fluctuations prudently.

Setting Investment Goals and Risk Tolerance

Before diving into the stock market, defining clear investment objectives is crucial. These goals serve as guiding principles, outlining your goals through your investments. They could range from saving for retirement, funding education, or generating passive income. Understanding your objectives helps tailor your investment strategy to align with these goals.

Assessing Risk Tolerance Levels

- Risk Assessment Questionnaires and Tools: Risk tolerance refers to an investor’s willingness and capacity to withstand fluctuations or potential losses in their investments. Various tools and questionnaires are available to help investors assess their risk tolerance levels. These assessments often consider factors like age, income, investment goals, and the time horizon for investment.

- Balancing Risk and Return Expectations: Finding a balance between risk and return is critical to investing. Higher returns usually accompany higher risks. Understanding this relationship is pivotal in creating a well-balanced investment portfolio. Conservative investors might opt for lower-risk investments with potentially lower returns, while aggressive investors might accept higher risks for higher returns.

By aligning investment goals with risk tolerance levels, investors can develop an investment strategy that not only aims to achieve financial objectives but also considers their comfort level with potential risks involved in the market. This alignment fosters a more realistic and sustainable investment approach.

Risk Management Tools and Techniques

- Stop Loss Orders: Stop-loss orders are preventive measures investors use to limit potential losses on a trade. They set a predetermined price at which an asset will automatically be sold, minimizing losses if the price moves against the investor’s position. While they don’t guarantee protection from all losses, they act as a risk management tool by enforcing a discipline to cut losses and protect capital.

- Hedging Strategies: Hedging involves using financial instruments like options, futures, or derivatives to counterbalance potential losses within an investment. For instance, purchasing a put option on a stock allows an investor to sell it at a specified price, protecting against potential downward movements in its value. Similarly, futures contracts provide a means to hedge against unfavorable price changes.

Using these tools requires a thorough understanding of their mechanics and associated risks. Improper use might amplify losses rather than mitigate them.

Using Risk-Adjusted Returns: Sharpe Ratio, Sortino Ratio

Risk-adjusted returns, like the Sharpe Ratio and Sortino Ratio, measure an investment’s return on its risk. The Sharpe Ratio evaluates an investment’s return compared to its volatility or risk, providing insight into whether the return justifies the risk taken. Meanwhile, the Sortino Ratio focuses on downside risk, explicitly measuring the return against downside volatility.

These ratios enable investors to assess investments based on their potential returns alongside the correlated level of risk associated with those returns. They are valuable tools for comparing investment options and making informed decisions aligned with risk management goals.

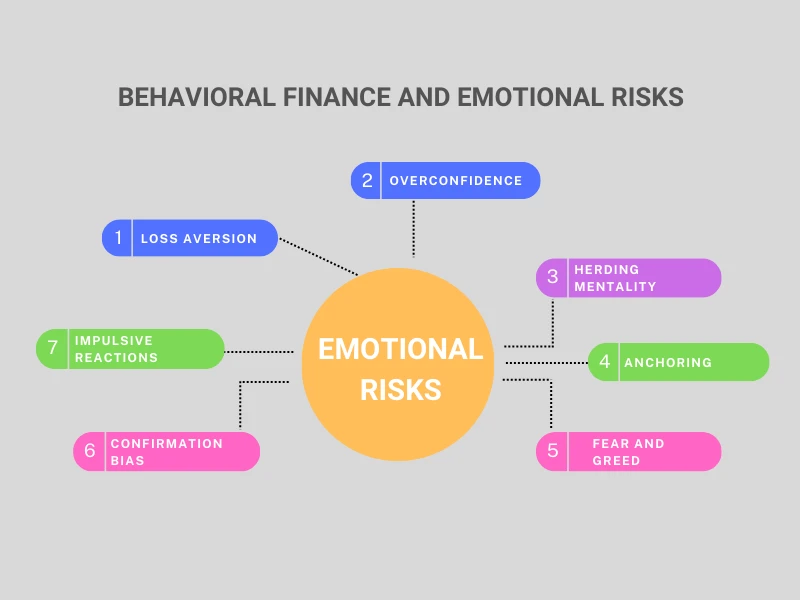

Behavioral Finance and Emotional Risks

- Loss Aversion: This bias is known as loss aversion, which means that investors feel the pain of losses more acutely compared to the pleasure of gains. As a result, investors might hold onto losing investments, hoping they’ll recover rather than cutting losses.

- Overconfidence: Investors sometimes overestimate their abilities to predict market movements or the performance of specific stocks. This can lead to taking on more risk than is prudent.

- Herding Mentality: This bias occurs when investors follow the majority’s actions without conducting research. This behavior can lead to inflated asset prices due to market bubbles or sudden crashes when everyone rushes to sell.

- Anchoring: Investors often get fixated on a particular piece of information, such as the purchase price of a stock, and make subsequent decisions based on this initial value. This can prevent them from adapting to new information.

- Fear and Greed: Fear of losses or missing out on potential gains can lead to impulsive actions. Fear might drive selling during market downturns, while greed might push investors to chase unrealistic returns.

- Confirmation Bias: Investors tend to search for information that supports their current beliefs while disregarding any contradictory data. This can limit their ability to make objective and well-informed decisions.

- Impulsive Reactions: Emotional decision-making often leads to impulsive actions in response to short-term market fluctuations, which might not align with a well-thought-out investment strategy.

Overcoming Emotional Pitfalls in Investing

- Education and Awareness: Understanding these biases helps investors recognize them in their decision-making process, enabling them to counter their impact.

- Creating and Sticking to a Plan: Developing a solid investment plan based on thorough research and sticking to it, irrespective of short-term market fluctuations, can help avoid impulsive decisions driven by emotions.

- Consulting Financial Advisors: Seeking advice from professionals who can provide objective insights and guidance can assist in making more rational and calculated investment choices.

Recognizing these biases and emotional triggers is the first step toward making more rational investment decisions. By applying disciplined approaches and strategies, investors can mitigate the negative impact of emotions on their investment outcomes.

Risk Management Best Practices

- Assessment: Begin by identifying and understanding the various risks associated with different investments. This involves evaluating market risks, geopolitical risks, economic risks, and any specific risks tied to the assets or sectors you’re invested in. Understanding these risks is fundamental to developing strategies to mitigate them.

- Strategy Development: Once risks are identified, create strategies tailored to manage these risks effectively. This might involve setting stop-loss orders, employing hedging techniques, or diversifying your portfolio across various asset classes to spread risk.

- Diversification: Allocating your investments across a range of different asset classes (like bonds, stocks, real estate, etc.) and sectors helps reduce unsystematic risk, which is specific to particular assets or industries. This spreads risk and lessens the influence of underperformance in a single investment on the overall portfolio.

- Contingency Planning: Anticipate and prepare for unexpected events impacting your investments. Back-up plans or access to emergency funds can provide a safety net during market volatility or unforeseen circumstances.

- Periodic Review: Regularly review your investment portfolio’s performance against your set objectives. This involves assessing whether your investments are on track to meet your financial goals and evaluating if there are any significant deviations from your initial plan.

- Rebalancing: Make necessary adjustments to your portfolio to maintain the desired asset allocation. For instance, if certain assets have performed exceptionally well and now dominate your portfolio, consider rebalancing by selling a portion to reallocate funds to underperforming or undervalued assets.

- Adapting to Market Changes: Stay informed about economic and market conditions. Adjust your investment strategies accordingly as market dynamics change. Adapting to shifts in the economic landscape can help you optimize your portfolio’s performance and mitigate potential risks.

Risk Management During Economic Shifts

Explore how economic indicators influence stock markets by visiting The Impact of Economic Indicators on Stocks

Managing Risks During Bull and Bear Markets

Understanding the risks and strategies associated with bull and bear markets helps investors navigate varying market cycles more effectively.

- Bull Markets: In bullish periods, where markets are rising, it’s crucial not to get overly optimistic and take on excessive risk. Adhere to your risk management strategy and avoid making impulsive investment decisions driven solely by the prevailing market sentiment. Consider diversifying across asset classes to mitigate the impact of potential market corrections.

- Bear Markets: During downturns or bearish phases, focus on capital preservation. Review your portfolio to identify vulnerable areas and consider reallocating assets to safer options. While it may be tempting to sell everything, sticking to a well-thought-out plan and avoiding panic selling is key to weathering the storm.

Strategies for Volatile Market Conditions

- Quality Investments: During economic downturns or recessions, prioritize quality investments—those with strong fundamentals, stable earnings, and resilient business models. These tend to weather turbulent times better.

- Defensive Sectors: Consider allocating funds to defensive sectors like healthcare, utilities, or consumer staples. These industries are less sensitive to economic fluctuations and can provide stability during volatile periods.

- Dollar-Cost Averaging: Making consistent investments at set intervals can mitigate the effects of market volatility by spreading purchases across various market conditions.

Future Trends in Risk Management

Integrating technological advancements in risk assessment and management transforms how investors perceive and manage risks. Harnessing these tools can lead to more proactive and adaptive risk management strategies in the ever-evolving landscape of financial markets.

Technological Advancements in Risk Assessment

- Big Data Analytics: The use of big data enables a more comprehensive analysis of market trends, economic indicators, and investor behavior. Processing vast amounts of data empowers investors to make better-informed decisions and identify potential risks more accurately.

- Predictive Analytics: Advanced statistical models and algorithms help predict market movements and identify patterns that might indicate future risks. This allows investors to adjust their strategies to mitigate potential downsides proactively.

AI and Machine Learning in Risk Analysis

- Pattern Recognition: AI and machine learning algorithms excel in recognizing complex patterns in market data, enabling more accurate risk assessment and prediction.

- Real-Time Risk Monitoring: These technologies allow for real-time monitoring of market conditions, enabling investors to react swiftly to changing dynamics and potential risks.

- Customized Risk Profiles: AI-driven tools can create personalized risk profiles for investors, considering individual preferences and tolerances, leading to more tailored risk management strategies.

Conclusion

Effective risk management is the bedrock of success in stock market investing. Understanding and acknowledging the diverse risks, from market volatility to emotional biases, empowers investors to make informed decisions. Diversification, regular portfolio reviews, and leveraging advanced tools like AI-driven risk analysis all contribute to a robust risk management strategy. Encouraging a proactive approach that prioritizes continual learning, adaptability, and a long-term vision solidifies the foundation for navigating the ever-evolving market landscape. By embracing these principles and strategies, investors can mitigate risks, optimize returns, and chart a steady course toward their financial goals amidst the inherent uncertainties of the stock market.