Average Share Price Calculator for Stock Trading

Average Price: 0.00

- Importance of Accurate Average Share Price Computation

- Benefits of Using an Average Share Price Calculator

- Leveraging Average Share Price in Trading

- How to use this average share price calculator

- Ensuring Accuracy: Validating and Handling Data

- Strategies for Utilizing Average Share Price Calculations

- Enhancing Trading Strategies with the Average Share Price Calculator

- Conclusion

Have you ever needed a quick way to calculate the average price of shares with varying share prices and quantities? Whether managing a stock portfolio or simply trying to determine the average cost per share, having a tool at your fingertips can make all the difference.

Calculating the average share price might sound straightforward, but its significance in the trading is immense. Imagine this: you’ve invested in various stocks over time, each at a different price. Figuring out your average cost per share isn’t just a matter of adding numbers – it’s about gaining clarity in your investments. Knowing this average can guide your decisions, offering a more accurate view of your portfolio’s performance. It’s like having a clearer lens to analyze your trading journey.

Importance of Accurate Average Share Price Computation

When it comes to your trading moves, accuracy is critical. The average share price isn’t merely a number on a spreadsheet; it’s the cornerstone for making informed decisions. Picture this scenario: you’re considering buying more shares of a particular stock. By accurately calculating your average share price, you gain a realistic understanding of how this new purchase will impact your overall investment. It’s about precision in navigating the markets, minimizing the risk of skewed perceptions, and maximizing your potential gains. You can use intraday stock calculator for how many shares can bought with your capital.

Benefits of Using an Average Share Price Calculator

1. Minimizing Risk through Informed Decision-Making

Wouldn’t it be great to make trading decisions with confidence? That’s where an average share price calculator steps in. It’s your ally in reducing risk by providing a clear picture of your investments. Whether you plan to buy, sell, or hold on to shares, this tool equips you with accurate data. It’s like having a GPS for your trading journey, guiding you to make more informed choices and steering clear of potential pitfalls.

2. Strategies Empowered by Accurate Averaging

Precision in trading is a game-changer. An average share price calculator empowers you to fine-tune your strategies. Want to evaluate your portfolio’s performance or diversify your investments? Understanding the average price you’ve paid for your shares is fundamental. It’s about harnessing this information to optimize your trading playbook, making calculated moves that align with your goals. With this tool, you can navigate the markets with a sharper focus.

Leveraging Average Share Price in Trading

1. Using Historical Data for Calculations

Trading isn’t just about the present; it’s also about understanding the past. Leveraging the average share price involves tapping into historical data and crunching the numbers of your past trades. Think of it as retracing your steps in the stock market journey. Using this historical data, you’re not just analyzing what happened – you’re gaining insights into patterns and trends. It’s about learning from your trading history to make more innovative moves in the future, armed with a deeper understanding of how prices have fluctuated over time.

2. Impact on Buy/Sell Decisions and Portfolio Rebalancing

The average share price isn’t just a statistic; it’s a compass guiding your buy and sell decisions. Imagine you’re contemplating selling some shares. Knowing your average share price helps you set a realistic benchmark – a point where you’re comfortable making a profit. Conversely, when you’re eyeing new stocks to buy, this calculation offers a baseline for assessing the potential return on investment. Plus, when it’s time to rebalance your portfolio, having a clear average share price in mind enables you to make calculated adjustments, ensuring your investments align with your financial objectives. It’s about using this calculated metric as a strategic tool, guiding your decisions in the dynamic trading landscape.

How to use this average share price calculator

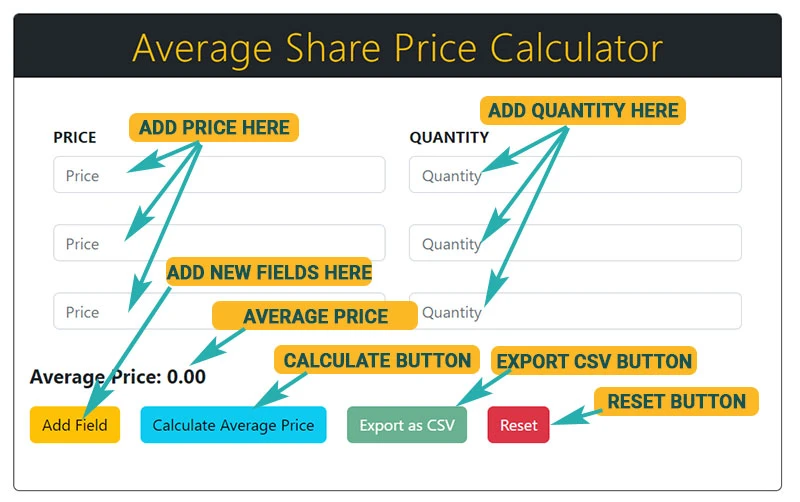

Locate the Input Fields: You’ll typically find designated fields to input the share prices and corresponding quantities.

- Enter Share Prices and Quantity: Fill in the fields with the prices you bought for each batch of shares. For example, if you purchased 120 shares at $11 each and then another 150 shares at $12 each, input these values accordingly. Enter the corresponding quantities or the number of shares bought at each price. In the example, input 100 for the first batch and 150 for the second batch.

- Add More Field: By default, this calculator has three sets of input fields (price and quantity). If you need more field sets, you can add whatever you want by clicking the “Add Field” button.

- Calculate the Average: After you complete your data inputs, look for a “Calculate Average Price” button to compute the average share price. Click on the button to trigger the calculation process. Then, the calculator will process the data and display the average share price. Check the output provided by the calculator, which will show you the average price per share based on the data you inputted. The displayed average share price represents the overall average cost per share, considering all the different prices and quantities entered.

- Resetting the Calculation: For resetting the calculation, look for a button labeled “Reset” to reset the calculation. Click this button to clear all the input fields and start afresh if needed. This helps when you want to re-enter data or start a new calculation from scratch.

- Export Calculations: After calculating the average, the “Export as CSV” button will become enabled. Click the “Export as CSV” button to generate a .csv file containing the entered prices, quantities, and the calculated average share price. You’ll then be prompted to download and save this file for future reference.

- Save and Refer: Open the downloaded .csv file using a spreadsheet application (e.g., Excel, Google Sheets) to view and keep a record of your share prices, quantities, and the calculated average price for future analysis or reference in your trading activities.

Use this calculated average share price as a reference point for making trading decisions. It can aid in evaluating current stock prices, determining potential profits or losses, and balancing your portfolio.

Ensuring Accuracy: Validating and Handling Data

- Error Handling and Data Validation Techniques: In trading, precision is paramount. That’s why this average share price calculator comes equipped with error handling and data validation techniques. It’s like having a safety net to catch any potential mistakes. From ensuring that only valid data is entered to alerting you in case of discrepancies, these techniques work silently in the background, ensuring the accuracy of your calculations. It’s about instilling confidence in your numbers and giving you peace of mind in your trading decisions.

- Minimizing Calculation Errors for Precise Results: Have you ever heard the phrase “measure twice, cut once”? That’s the essence of minimizing calculation errors in this calculator. By meticulously scrutinizing each step of the calculation process, this tool is designed to deliver precise results. It’s about going the extra mile to ensure that the average share price you receive is as accurate as possible. After all, every decimal point matters in the fast-paced world of trading.

Strategies for Utilizing Average Share Price Calculations

- Utilizing Moving Averages for Trading Indicators: Have you ever wondered how seasoned traders spot trends? Enter moving averages – a powerful tool in a trader’s arsenal. By utilizing the average share price as a moving average, this calculator can help you identify trends in stock prices over time. Armed with this information, you’re better equipped to make informed decisions, whether it’s identifying potential entry or exit points in the market. See How Moving Averages Predict Market Moves

- Position Sizing and Risk Management Techniques: Trading isn’t just about making profits; it’s also about managing risks. The average share price calculator isn’t just a number-crunching tool; it’s a strategic companion for position sizing and risk management. Understanding your average share price gives you a clearer perspective on how much to invest in each position. It’s about balancing potential gains and acceptable risks, ensuring that your trading strategy aligns with your risk tolerance.

Enhancing Trading Strategies with the Average Share Price Calculator

What if you could elevate your trading plans to a new level of precision? The average share price calculator isn’t just a standalone tool; it’s a catalyst for enhancing your trading strategies. By integrating average share price calculations into your plans, you’re not merely making calculations but refining your technique. It’s about infusing your trading playbook with data-driven insights, ensuring your decisions are rooted in a deep understanding of your investments. With this integration, you’re stepping into a realm where strategies aren’t just theoretical but backed by precise calculations.

Advanced Tips and Tricks for Optimizing Results

Ready to take your trading game to the next level? Brace yourself for some advanced tips and tricks that can unlock the full potential of the average share price calculator. From leveraging historical data for predictive analysis to employing sophisticated techniques for interpreting moving averages, these insights are like secret keys to unlocking tremendous success in trading. It’s about refining your approach, fine-tuning your strategies, and optimizing your results in the ever-evolving landscape of the stock market.

Conclusion

In a world where precision reigns supreme, the average share price calculator is a beacon of accuracy for traders. We’ve explored this invaluable tool’s myriad benefits and practical applications throughout this journey. From minimizing risks and aiding decision-making to optimizing trading strategies, the calculator is more than just a number-crunching device – it’s a strategic companion empowering traders with insights and clarity.

As we wrap up, consider this an invitation to incorporate the average share price calculation into your trading strategies. It’s not just about embracing a tool; it’s about embracing a mindset that values accuracy, informed decisions, and strategic planning. So, integrating your average share price into your strategies can be a game-changer. It’s about seizing control of your trading journey. It’s navigating the markets precisely and confidently. Embrace the power of accurate calculations, and let it fuel your success in trading.