Understanding Stock Portfolio Building

Hey there, future investor! Ready to dive into the world of stock portfolios? Let’s start by getting the basics down pat.

Building a solid stock portfolio is like putting together a winning team of investments. It’s not just about picking stocks; it’s about making smart choices that help your money grow. Think of it as creating a safety net for your financial future that can handle ups, downs, and everything in between. Today, we’re diving into the secrets of building a solid stock portfolio. It’s all about understanding what makes a good investment, managing risks, and setting yourself up for success in the stock market. Let’s get started on this exciting journey toward financial strength!

What is a Stock Portfolio?

A stock portfolio is like a mix of different things you own, but instead of toys or clothes, it’s a collection of investments you’ve made in companies. It’s a bunch of different stocks, bonds, or other stuff you’ve bought from different companies. Each of these things has the potential to grow and make you more money. Think of it as having a bunch of pieces in a puzzle. Each one is different, but together, they make a picture of your financial future.

Simply put, it’s your basket of investments. It’s like assembling your dream team of companies or assets, each with its own potential to shine.

Importance of Diversification

Diversification of stocks is like having a safety net for your money. It’s about not putting all your eggs in one basket. When you spread your investments across different companies or types of businesses, it helps lower the risk. If something goes wrong with one company, the others might still be doing okay, so you don’t lose everything.

It’s a bit like having different friends who are good at different things. If one can’t help, the others might step in. Diversification is a way to balance things out and make sure your money stays safer, even if one part of your investments doesn’t do well.

Setting Objectives for Your Portfolio

Alright, so why are you investing? Setting goals for your portfolio is like creating a roadmap for your money. It’s about knowing where you want to go and how you want to get there. Think about what you’re saving and investing for. Is it for a short-term goal like buying a car or a house, or for long-term goals, something way down the road like retirement?

Figuring out these goals helps you decide how much risk you’re comfortable with and how much time you are willing to give for your investments to flourish. It’s a bit like planning a trip; you need to know your destination and how you will reach it. Setting clear objectives for your portfolio guides your investment decisions and helps you stay on track toward your financial dreams.

How to select stock for your investment portfolio

Now, onto the nitty-gritty picking the right stocks. There are a couple of ways to go about it.

Researching stocks involves delving into the heart of companies to understand their financial health and potential for growth. It’s like being a detective, digging through a company’s reports, earnings, and debts to gauge its stability and profitability.

Fundamental analysis helps evaluate these aspects, providing insight into whether a company is worth investing in. This is like getting to know the ins and outs of a company. You dig into its financial health, look at P/E (price-to-earnings) or P/B (price-to-book) ratios, and snoop around its financial statements.

On the other hand, technical analysis focuses on charts and patterns, trying to predict future price movements based on historical data. Have you ever looked at stock charts and wondered what all those lines mean? That’s a technical analysis for you. It’s about spotting trends or patterns in the stock market, almost like reading the market’s mind.

Both fundamental and technical methods provide different angles to assess stocks, offering investors a comprehensive view before making investment decisions.

Market Trends and Sentiments

Understanding market trends and sentiments is like reading the pulse of the financial world. It involves staying attuned to the big picture, like global economic shifts, government policies, industry trends, and the smaller, company-specific news that can sway investor emotions.

Macro trends, such as interest rate changes or geopolitical events, impact entire markets, while micro factors like a company’s product launch or leadership change can influence its stock price. Awareness of these trends and sentiments helps investors predict market movements and make informed decisions on whether to buy, sell, or hold onto stocks. It’s like having a compass that guides you through the ever-changing landscape of the stock market.

Diversification Strategies

Time to play mixologist! A balanced portfolio isn’t just about stocks. It’s a blend of stocks, bonds, and other assets. Each brings its flavor and helps spread risk.

- Asset Allocation: This is like divvying up your investments among different categories to manage risk. Stocks, bonds, and some real estate. It’s like creating a superhero squad, each with its own power.

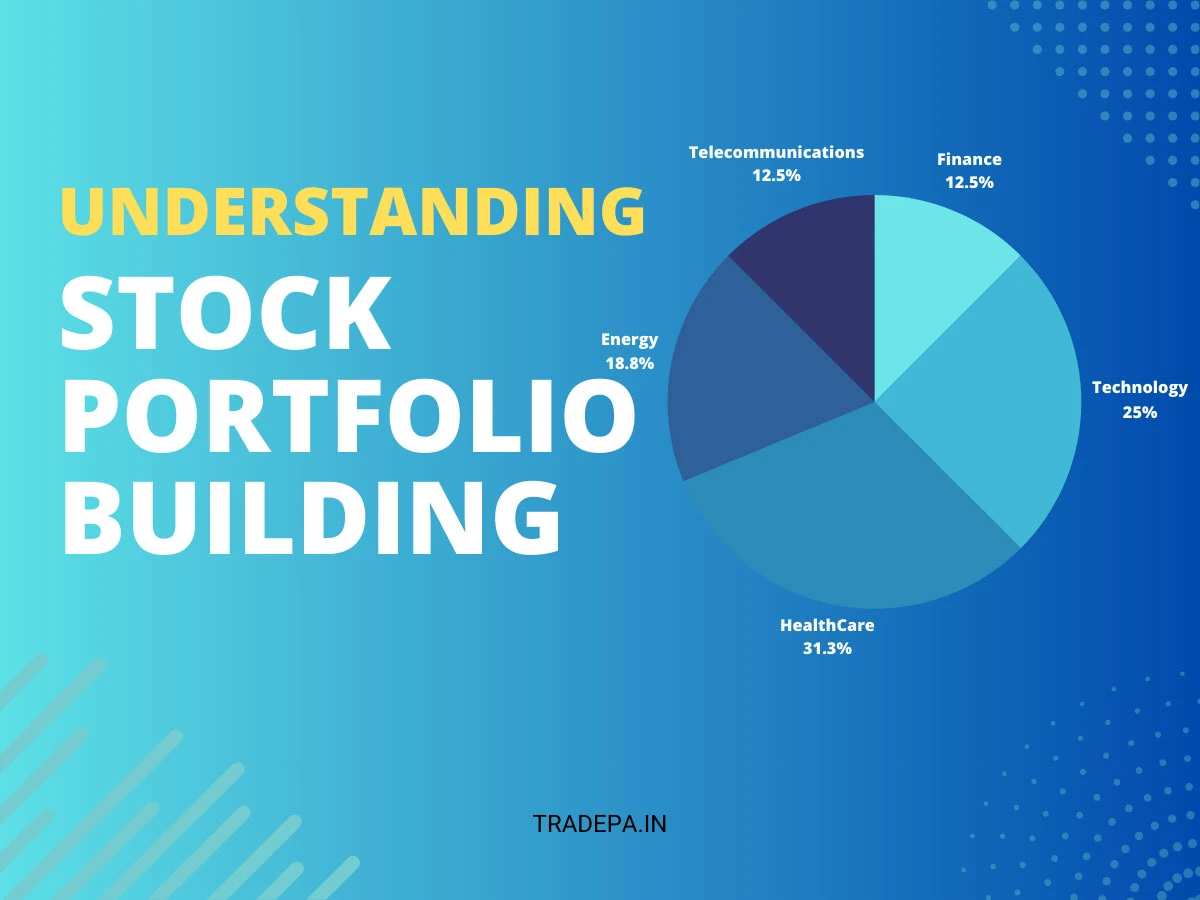

- Sector Diversification: Common sectors in the stock market include technology, healthcare, finance, consumer goods, energy, utilities, industrials, materials, and telecommunications. Different industries have different vibes - some thrive, some dive. Diversifying across industries can help manage risks specific to certain sectors.

- Geographic Diversification: Have you ever thought of going global? Exploring markets outside your home turf can be like adding spices to your dish; it adds flavor and spreads risks.

Risk Management Techniques

Risk comes in different flavors. Some risks are like the weather; everyone feels them (systematic), while others are company-specific (unsystematic). Read full article on risk management here.

Tools for Risk Mitigation

Think of these as your shields and safety nets in the investment world. Stop-loss orders set boundaries, while hedging strategies like options or futures can help protect your investments from market tantrums.

Stop-loss orders are like safety nets in the unpredictable world of investing. They're an intelligent tool investors use to set a predefined price for selling a stock automatically. Essentially, it's an exit strategy designed to limit potential losses. By placing a stop-loss order, investors protect themselves from significant stock price downturns.

For example, if an investor buys a stock at $40 and sets a stop-loss order at $35, if the stock price falls to $35 or below, the order triggers an automatic sale, limiting the loss to a predetermined amount. This strategy helps investors manage risk and protect their investments, ensuring they don't endure substantial losses if a stock doesn't perform as expected.

Hedging strategies, such as options or futures, are like shields against uncertainty in the stock market. They're tools investors use to reduce the impact of potential losses by offsetting risks associated with their investments.

Both options and futures enable investors to hedge against market volatility or adverse price movements. These strategies act as insurance policies, protecting investors against unexpected market swings and minimizing potential losses in their investment portfolios.

Portfolio Monitoring and Rebalancing

Portfolio monitoring and rebalancing are the checkpoints and fine-tuning tools of a savvy investor’s journey. Monitoring involves keeping a close eye on how your investments are performing. It’s like regularly checking the health of your plants to ensure they’re growing well.

Investors gain insights into their portfolio’s performance by tracking metrics such as returns and volatility and comparing them to benchmarks.

Sometimes, your portfolio needs a makeover. Rebalancing means tweaking your investments to align with your goals and comfort zone. It involves realigning your investments to maintain your desired asset allocation. It means tweaking the mix of stocks, bonds, or other assets when they drift from your initial plan. This process helps manage risk and ensures that your portfolio aligns with your financial goals, adapting to market changes or circumstances along the way.

Long-term Perspective and Patience

Think of long-term investing as planting a tree. It takes time to grow, but once it does, it provides shade and fruits for years.

Compound Growth and Time in the Market: Have you ever heard of the snowball effect? It’s like your money grows, then it grows on what it’s already grown. Time is your best friend here.

Weathering Market Volatility: Markets can be like roller coasters ups, downs, twists, and turns. Patience helps you ride it out without losing your lunch.

Embracing Patience and Discipline

No emotional decisions here! Focusing on your long-term vision and avoiding impulsive reactions are key to success.

Conclusion

Let’s wrap this up with a neat little bow. Defining your goals, picking stocks wisely, and balancing diversification and risk management are the cornerstones.

Here’s a pat on the back! Keep learning, stay adaptable, and build a strategy that can dance in any market rhythm. Cheers to a strong, robust portfolio.