Trends in Market Cycles Every Investor Should Know

Introduction

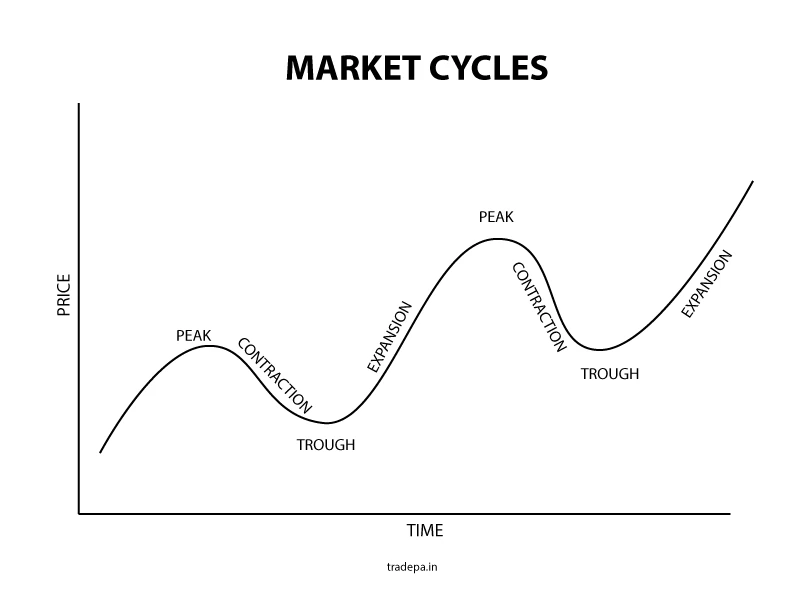

Understanding market cycles is crucial for investors seeking to maximize their returns and minimize risks. Market cycles, which consist of periods of growth (expansion), peaks, contraction (recession), and troughs (bottoms), represent the inherent fluctuations in economic activity. Knowledge of market cycles helps investors avoid the pitfalls of panic selling during downturns and the temptations of over-enthusiastic buying during peaks. By understanding the phases of market cycles, investors can better anticipate changes and adjust their portfolios to align with the market’s current and expected conditions. This understanding provides a long-term perspective, helping investors stay focused on their financial goals despite short-term market volatility.

How Trends Influence Investment Decisions

Trends have a significant impact on shaping investment decisions. They offer insights into the direction in which markets are moving, driven by various economic, technological, and sociopolitical factors. Identifying and analyzing these trends enables investors to align their strategies with broader market movements, potentially leading to more profitable outcomes.

- Economic trends, such as fluctuations in interest rates, inflation, and GDP growth, can signal shifts in market cycles and influence asset prices.

- Technological advancements can generate new investment opportunities and disrupt existing markets, prompting investors to adjust their portfolios to capitalize on or mitigate the impact of these changes.

- Sociopolitical events, including elections, policy changes, and global conflicts, can also impact market trends, requiring investors to stay informed and adaptable.

What are Market Cycles?

Market cycles are the recurring phases of expansion and contraction in an economy or financial market. These cycles reflect the natural fluctuations in economic activity, typically driven by various factors such as consumer confidence, interest rates, and business investments. Understanding market cycles helps investors anticipate changes in the market and make strategic decisions to optimize their investments.

1. Expansion Phase

During this phase, the economy grows as businesses invest, consumer spending increases and employment rises. Asset prices typically increase as demand grows.

The expansion phase is a period of economic growth and increasing market activity. Several key indicators show positive trends during this phase, reflecting a robust and healthy economy. The expansion phase is typically characterized by:

- Increasing Gross Domestic Product (GDP): A steady rise in GDP indicates a growing economy. Businesses produce more goods and services, contributing to economic output.

- Rising Employment: Companies hire more workers to meet increased demand, lowering unemployment rates. Job creation is a significant sign of economic strength during this phase.

- Higher Consumer Spending: As employment rises and wages increase, consumer confidence grows. People are more willing to spend on goods and services, fueling economic growth.

- Business Investments: Companies invest in new projects, technology, and infrastructure, anticipating continued economic expansion. This investment supports future growth and innovation.

Expansion Phase Impact on Financial Markets

The expansion phase positively impacts financial markets, increasing asset prices and investor confidence. Key aspects of this impact include:

- Bull Markets: Stock markets often experience a bull run during expansion, with stock prices rising as corporate earnings grow. Investors are optimistic and willing to invest more in equities.

- Real Estate Growth: Property values tend to increase as housing and commercial real estate demand rises. Low interest rates during this phase make borrowing more affordable, further boosting real estate markets.

- Commodity Prices: Demand for commodities such as oil, metals, and agricultural products generally increases, driving up prices. This is due to higher industrial production and consumer demand.

2. Peak Phase

The peak phase signifies the highest point of the market cycle, where economic activity and asset prices reach their maximum levels before starting to decline. Growth rates begin to slow, and the market shows signs of overvaluation. This phase is marked by several key characteristics that signal a potential reversal in the market:

- Slowing Growth: Although the economy is still growing, the growth rate begins to slow down. GDP growth rates may plateau or show only modest increases.

- High Valuations: Asset prices, including stocks and real estate, reach unusually high levels, often driven by investor optimism and speculation. Price-to-earnings (P/E) ratios for stocks may become inflated.

- Signs of Overheating: Inflation rates may rise as demand outstrips supply. Labour markets become tight, with low unemployment rates leading to wage inflation.

Peak Phase Impact on Financial Markets

The peak phase has significant implications for financial markets, as it often precedes a period of correction or decline. Understanding these impacts can help investors prepare for potential market shifts:

- Increased Volatility: As market sentiment shifts, volatility tends to rise. Investors may become more uncertain about future economic prospects, leading to sharp price fluctuations.

- Profit-Taking: Investors may start to sell off assets to lock in gains, leading to downward pressure on prices. This can trigger broader market corrections if large numbers of investors begin to exit simultaneously.

- Sector Rotation: Investors may shift their focus from growth-oriented to more defensive sectors, such as utilities, healthcare, and consumer staples, which tend to perform better during economic slowdowns.

3. Contraction Phase

The contraction phase, also known as the downturn or recession phase, is a period of economic decline following the peak of a market cycle. During this phase, economic activity slows, and several key indicators reflect a shrinking economy:

- Decreasing GDP: Gross Domestic Product (GDP) growth rates turn negative, reducing the overall economic output. Businesses produce less as demand wanes.

- Rising Unemployment: Due to reduced demand for goods and services, companies cut back on hiring and may lay off employees, leading to higher unemployment rates.

- Falling Consumer Confidence: As economic conditions worsen, consumer confidence declines. People become more cautious with their spending, further dampening economic activity.

- Declining Investment: Business investments slow down or halt as companies fear prospects. This reduction in capital expenditure impacts economic growth.

- Lower Inflation or Deflation: Price levels may stabilize or decline as demand decreases. In some cases, deflation (a general decrease in prices) can occur, further depressing economic activity.

Contraction Phase Impact on Financial Markets

The contraction phase significantly impacts financial markets, leading to declining asset prices and increased volatility. Key aspects of this impact include:

- Bear Markets: Stock markets typically experience a bear market during the contraction phase, with prices falling as investor confidence wanes. Declining corporate earnings and economic uncertainty contribute to this downward trend.

- Real Estate Decline: Property values and real estate investments often suffer as demand for housing and commercial properties decreases. High debt levels can exacerbate these declines, particularly in markets that experienced speculative bubbles.

- Flight to Safety: Investors tend to move their money into safer assets, such as government bonds, gold, and cash, to preserve capital. This flight to safety can lead to rising bond prices and lower yields.

4. Trough Phase

The trough phase, the market bottom, is the lowest point in the market cycle. This phase follows the contraction phase and precedes the recovery or expansion phase. Key characteristics of the trough phase include:

- Lowest Economic Activity: Economic indicators such as GDP, employment, and industrial production are at their weakest. The economy contracts to its lowest point before starting to recover.

- High Unemployment: Unemployment rates are typically at their highest, with many businesses reducing their workforce significantly during the contraction phase.

- Low Consumer and Business Confidence: Consumer and business confidence are at their lowest levels, reflecting widespread pessimism about economic prospects. Spending and investment are minimal.

- Stable or Declining Prices: Inflation rates may stabilize or even turn into deflation as demand remains weak. Prices for goods and services are typically low.

Trough Phase Impact on Financial Markets

The trough phase has distinct impacts on financial markets, often presenting both challenges and opportunities for investors:

- Depressed Asset Prices: Stock prices, real estate values, and other asset prices are generally at their lowest levels. Market sentiment is negative, and valuations are often very attractive compared to historical levels.

- High Volatility: Although prices are low, markets can still be volatile as investors react to economic news and potential signs of recovery.

- Opportunities for Value Investing: The trough phase can present significant opportunities for value investors willing to take on risk in anticipation of an eventual recovery.

Predicting Future Trends in Market Cycles

Predicting future trends in market cycles is a critical aspect of investment strategy. It helps investors anticipate changes and adjust their portfolios accordingly. While the exact timing and nature of future market cycles are uncertain, several key factors and tools can help make educated predictions.

- Economic Indicators: Tracking key economic indicators such as GDP growth, unemployment rates, inflation, and consumer confidence can provide essential insights into the future trajectory of market cycles. For instance, a sustained period of GDP growth might signal an upcoming expansion phase, while rising unemployment could indicate a looming contraction.

- Technological Advances: Technological innovation continues to reshape industries and markets. Emerging technologies such as AI, blockchain, and renewable energy can create new growth opportunities and disrupt existing market dynamics. Monitoring technological trends can help predict which sectors might lead to the next market cycle.

- Geopolitical Events: Geopolitical developments, including trade policies, political stability, and international relations, significantly impact market cycles. For example, trade wars or geopolitical tensions can lead to economic uncertainty and market volatility, while stable political environments foster economic growth and investment.

Conclusion

Understanding trends in market cycles is essential for every investor aiming to navigate the complexities of financial markets effectively. Market cycles, characterized by phases of expansion, peak, contraction, and trough, are influenced by many factors, including economic indicators, investor sentiment, and geopolitical events.

Fear and greed significantly impact market movements. Investors can better manage their reactions by understanding the psychological factors that impact market cycles.

Technological advancements and the rise of AI are revolutionizing market analysis and predictions. These tools give investors deeper insights into market trends, enabling more accurate forecasting and strategic planning. Staying informed about technological trends and leveraging these advanced analytical tools can give investors a significant edge in anticipating market shifts and capitalizing on emerging opportunities.

As we look to the future, the ability to predict and adapt to market cycles will remain a crucial skill for investors. By continuously monitoring economic indicators, understanding the impact of sentiment, and embracing technological innovations, investors can prepare for success in a constantly evolving financial environment. Ultimately, a proactive and informed approach to investing will help ensure long-term financial growth and stability, regardless of where the market cycle stands.