Secrets of Discipline and Patience for Maximized Profits in Trading

Introduction

Trading isn't just about numbers and charts—it's about the mindset that guides every move. Successful trading relies on discipline and patience, yet these traits are often forgotten in the excitement of market fluctuations. Picture this: discipline is your compass, guiding decisions, while patience is your anchor, steadying you through the stormy seas of market volatility. Without these, trading becomes a gamble rather than a calculated strategy.

Why Discipline and Patience Matter

In the fast-paced world of trading, emotions often cloud judgment. Discipline acts as a rudder, keeping emotions in check and ensuring rational choices. It's the ability to stick to a plan even when the market tempts otherwise. On the other hand, patience acts as a buffer against impulsive actions. It's the capacity to wait for the right moment, allowing strategies to unfold without haste. Both elements are the bedrock of consistent and profitable trading, distinguishing savvy investors from impulsive gamblers.

Trading discipline isn't merely about following rules; it's a mindset cultivated through consistency and self-control. It involves adhering to predefined strategies, regardless of emotional impulses or external pressures. Discipline compels traders to stick to their risk management plans and trading methodologies, even when the market seems erratic. It's the ability to stay focused on long-term goals amid short-term fluctuations, ensuring a steady course through market highs and lows.

Mastering Emotions in Trading

Emotions play a pivotal role in trading, often leading to impulsive decisions that can erode profits. Understanding how emotions influence decision-making is critical. Fear and greed can distort perceptions, leading to rushed trades or holding onto positions longer than necessary. Techniques for emotional regulation—such as mindfulness exercises or practical strategies to recognize and manage emotions—act as shields against impulsive actions, empowering traders to make rational choices even in volatile markets.

Emotion and Decision Making

Emotions like Fear of Missing Out (FOMO) or the fear of losing profits often lead to impulsive actions. Similarly, greed can drive traders to overstay in profitable positions, deviating from their established strategies.

- Fear of Missing Out: Imagine a trader witnessing a sudden surge in a stock's price. The fear of missing out on potential profits might lead them to hastily enter the trade without conducting thorough analysis or waiting for a suitable entry point. This impulsive action is driven by the fear of missing an opportunity rather than a well-considered strategy.

- Fear of Loss: A trader who experiences a series of losses might become overly cautious and hesitant to take new positions even when the market presents favorable opportunities. This fear of further losses can paralyze decision-making, causing them to miss out on potentially profitable trades.

- Greed - Overstaying in Profitable Trades: After a successful trade, a trader might become greedy and refuse to exit the position, hoping for even higher profits. This greed might cause them to disregard their initial exit strategy or ignore warning signs of a potential market reversal, leading to losses as the market turns.

- Greed - Chasing High Returns: A trader might chase high returns by investing in volatile assets or high-risk securities without proper analysis or risk management. The desire for quick and substantial gains can lead to overlooking the associated risks, resulting in significant losses.

- Impact on Rationality: Emotions can cloud rational judgment. Emotional decisions might ignore crucial market indicators or overemphasize insignificant signals, leading to suboptimal choices.

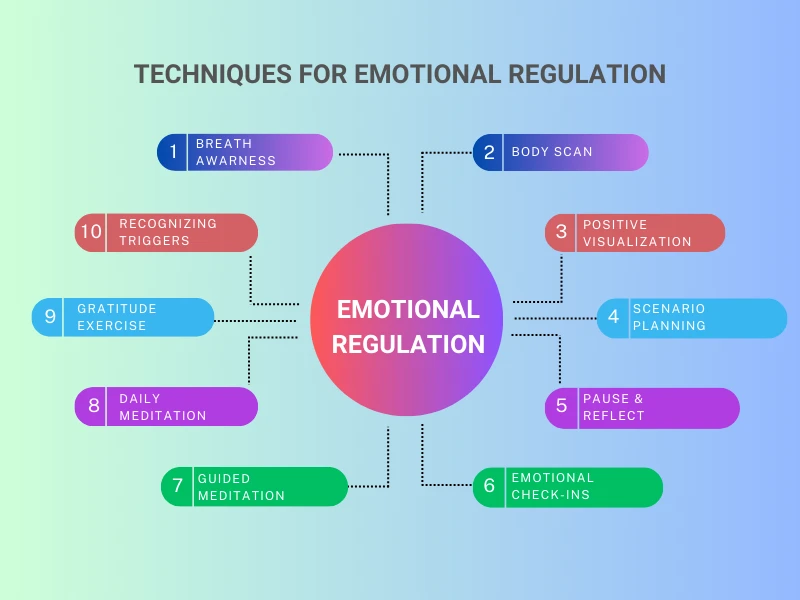

Techniques for Emotional Regulation

Techniques such as breathing exercises or mindfulness meditation can help traders stay present and composed, reducing the influence of emotions on decision-making.

- Breath Awareness: Practicing focused breathing exercises during trading sessions can help maintain concentration and reduce stress. Traders can focus on their breath, taking deep inhales and exhales, to anchor themselves in the present moment.

- Body Scan: Periodically conducting a quick body scan—observing sensations from head to toe—helps traders notice tension or stress, allowing them to consciously relax and refocus.

- Positive Visualization: Visualizing successful trades or calmly navigating through volatile market situations can instill confidence and a composed mindset.

- Scenario Planning: Imagining various market scenarios and mentally preparing for different outcomes reduces anxiety and helps traders respond rather than react impulsively.

- Pause and Reflect: Encouraging traders to pause before making a trade, considering the rationale behind the decision, and evaluating potential emotional influences fosters a more deliberate decision-making process.

- Emotional Check-ins: Implementing periodic emotional check-ins during trading hours helps traders recognize any arising emotions and address them before making impulsive decisions.

- Guided Meditation Sessions: Participating in guided meditation sessions specifically designed for traders can assist in enhancing focus, reducing stress, and promoting emotional resilience.

- Daily Mindfulness Routine: Integrating short mindfulness practices into daily routines, such as a morning meditation session or a brief mindful pause before trading, establishes a proactive approach to managing emotions.

- Gratitude Exercises: Reflecting on aspects of trading that bring gratitude—whether it's learning from mistakes or gaining new insights—cultivates a positive mindset, reducing the impact of negative emotions.

- Recognizing Emotional Triggers: Identifying personal triggers that evoke emotional responses in trading scenarios allows for proactive measures to manage these triggers effectively. Keeping a trading journal helps identify patterns in emotional responses to certain market conditions or trading scenarios.

Strategies to Manage Emotions

- Setting Clear Rules: Establishing predefined rules and guidelines helps override emotional impulses. This could involve having strict entry and exit criteria or predetermined risk management strategies.

- Utilizing Automation: Automated trading systems or limit orders can remove the need for constant decision-making, reducing emotional interference during trades.

- Seeking Support and Guidance: Engaging with a trading community or mentorship programs provides opportunities to discuss emotions and gain insights into managing them effectively. Seeking guidance from trading psychologists or counselors can assist in developing personalized strategies to handle emotions in trading.

Components of Trading Discipline

- Risk Management: Effective risk management isn't just about protecting capital but preserving the mental capital needed for disciplined trading. Setting risk tolerance levels and implementing stop losses and take profits are pivotal. They prevent emotional decision-making during trades, providing a clear exit strategy and safeguarding against excessive losses.

- Trading Plan Development: A well-crafted trading plan is a roadmap, anchoring traders in disciplined strategies. It includes entry and exit rules, risk-reward ratios, and guidelines for different market scenarios. Consistency in following this plan is the essence of trading discipline, ensuring actions are driven by strategy rather than impulse.

Patience in Trading

Patience in trading is akin to a seasoned sailor waiting for the opportune wind to set sail. It involves enduring temporary market fluctuations without deviating from the predetermined course. Patience allows traders to stay composed amid market uncertainties, avoiding impulsive decisions driven by the need for immediate gratification. It's the acknowledgment that profitable opportunities often require time to materialize, and rushing into trades can jeopardize long-term success.

Strategies for Developing Patience

Patience in trading isn't about idleness but rather about strategic waiting. It's the ability to remain steadfast in executing trades only when the conditions align with a predefined strategy, ensuring that decisions are driven by a calculated approach rather than emotional impulses.

1. Identifying Ideal Entry and Exit Points

- Thorough Analysis: Conducting comprehensive market analysis and technical research aids in identifying optimal entry and exit points. Rather than acting impulsively, patience lies in waiting for these specific conditions to align before executing a trade.

- Confirmation Signals: Waiting for confirmation signals from various indicators or chart patterns validates potential entry or exit points, instilling confidence and reinforcing patience in decision-making.

2. The Art of Waiting Without Wavering

- Setting Realistic Expectations: Understanding that markets operate in cycles helps accept that not every moment is ideal for trading. Patience involves accepting periods of inactivity while waiting for favorable market conditions.

- Staying Disciplined: Adhering to the trading plan and resisting the temptation to deviate from it requires patience. It involves staying committed to predefined strategies, even during market uncertainty or minimal volatility.

Challenges in Maintaining Discipline and Patience

A. Common Obstacles Faced by Traders

1. Impulse Trading and Its Consequences

- Emotional Triggers: Impulse trading often arises due to emotional prompts like the fear of missing out (FOMO) or the desire to recover losses quickly.

- Consequences: Acting impulsively can lead to deviating from the trading plan, taking trades that don't align with strategies, and ultimately resulting in increased risk and potential losses.

2. Overtrading

- Chasing Trades: Overtrading stems from a constant need to be active in the market, leading to excessive trade frequency without adequate analysis or valid setups.

- Impact on Patience: It undermines patience by exhausting capital, eroding profits, and hindering the ability to wait for high-probability opportunities.

B. Handling Losses

1. Learning from Losses

- Analyzing Mistakes: Viewing losses as learning opportunities helps in understanding what went wrong and how to avoid similar pitfalls in the future.

- Adapting Strategies: Using the insights gained from losses to refine and improve trading strategies fosters growth and resilience.

2. Maintaining Composure During Drawdowns

- Emotional Resilience: Drawdowns can trigger emotional responses like frustration or anxiety. Developing emotional resilience involves acknowledging these feelings while maintaining a rational mindset.

- Sticking to Plan: Discipline during drawdowns is crucial. Patience is required to weather the storm, staying true to the trading plan without making impulsive decisions to recover losses hastily.

Navigating through these challenges demands a concerted effort to maintain discipline and patience. Overcoming impulsive tendencies, avoiding overtrading, and managing losses effectively are pivotal in sustaining a disciplined and patient approach toward trading.

Practical Tips

1. Surrounding Yourself with Like-minded Individuals

Joining trading communities or forums provides a supportive network of like-minded individuals. Discussions, shared experiences, and insights can reinforce discipline and patience by learning from others' journeys.

2. Utilizing Technology for Accountability

- Trading Tools and Apps: Utilizing trading apps or platforms offering trade tracking, performance analysis, and goal setting can instill discipline through measurable accountability.

- Accountability Partners: Partnering with a fellow trader for mutual support and accountability fosters discipline by setting goals, sharing progress, and offering constructive feedback.

3. Morning Routines and Mental Preparation

- Mindful Start: Starting the day with calming activities like meditation, exercise, or reading helps set a focused and composed mindset for the trading day ahead.

- Pre-trading Rituals: Reviewing market news, analyzing pre-market conditions, and outlining trade strategies during morning routines instills discipline in preparation and planning.

4. Reflective Practices at Day's End

- Trade Review Sessions: Reflecting on the day's trades, analyzing decisions made, and identifying instances where discipline and patience were maintained or compromised enhances self-awareness.

- Setting Tomorrow's Intentions: Planning and setting intentions for the next trading day reinforce discipline by outlining goals and strategies.

Overcoming Setbacks and Staying the Course

A. Adapting and Adjusting

- Market Dynamics: Recognizing that markets evolve is crucial. Flexibility allows traders to adapt strategies to changing market conditions, ensuring they remain relevant and practical.

- Revisiting Strategies: Embracing flexibility means regularly evaluating and adjusting trading strategies based on performance and market shifts, fostering resilience and adaptability.

B. Dealing with Frustration and Rekindling Motivation

- Acceptance of Setbacks: Acknowledging that setbacks are part of the trading journey helps manage frustration. Understanding that losses are learning opportunities reduces emotional turmoil.

- Positive Mindset: Cultivating a positive outlook by focusing on progress, irrespective of setbacks, rekindles motivation and maintains a resilient attitude towards trading.

- Taking Breaks: Stepping away from the screens during periods of frustration provides perspective and prevents emotional decision-making.

- Learning from Experience: Reflecting on past setbacks and identifying the lessons learned fuels motivation and prevents repeating similar mistakes.

Conclusion

Discipline and patience stand as pillars of success in trading. Discipline ensures adherence to well-defined strategies, risk management, and a structured approach to decision-making. On the other hand, patience fosters the ability to wait for high-probability trade setups, endure market fluctuations, and maintain composure during challenges. The symbiotic relationship between discipline and patience forms the bedrock upon which profitable and sustainable trading journeys are built.

The trading journey is not solely about financial gains but also personal growth. Embracing discipline and patience is more than a skill; it's a mindset. It requires continual effort, self-reflection, and a commitment to improvement. By cultivating discipline, traders navigate the markets with a structured approach, while patience allows them to weather storms and wait for the right opportunities. Embracing this journey equips traders with trading prowess and valuable life skills of resilience, adaptability, and emotional intelligence.

In the pursuit of trading success, remember that discipline and patience are not quick fixes but lifelong companions on the path to achieving financial goals and personal fulfillment.