Requirements to get started with stock market trading

Trading in the stock market involves purchasing and selling stocks, bonds, and other types of securities to make money. It’s not just about making money; it’s the chance to be part of something dynamic, where your decisions can shape your financial future. However, every rose has its thorns, and the stock market is no different. It offers rewards but also comes with risks.

In stock market trading, technology is used to make the trading process more efficient. It helps traders to make decisions faster and more accurately. In the past, traders made decisions based on intuition or gut feeling. But now, with the help of technology, they can make decisions with a high degree of accuracy by using quantitative and qualitative data. Knowing the different requirements one should meet before starting trading is essential.

Setting the Foundation

Imagine the stock market as a massive marketplace where pieces of companies are bought and sold. That’s precisely what it is! But let’s break it down. Common stocks are like owning a piece of a company, while preferred stocks offer different perks. Then there are the blue-chip stocks, the stalwarts of stability. Understanding these differences is crucial before stepping into the market.

Knowledge

The essential factor is the knowledge of stocks and bonds because it drives many people’s decisions to invest in stocks or bonds. It also helps investors understand what is happening in the stock market and why certain stocks are going up or down. Knowledge about different economic indicators, such as GDP growth rates, inflation rates, unemployment rates, interest rates, and consumer confidence levels, are essential factors affecting the stock market.

If you do not have any knowledge of stock market trading, you should not invest your hard-earned money. It is very risky if you do not know enough about the stock market.

Capital

Financial readiness - It’s like preparing for a journey; you need to know how much you’ll invest and set a budget for your trading activities. These steps lay the groundwork for a solid start.

The capital requirement in stock market trading is the amount of money a trader needs to open a position. The trader must have enough funds in their account to open a position.

The capital requirement varies depending on what type of trader you are, how much money you want to invest, and how much risk you’re willing to take.

This is just the beginning of our journey into the stock market. Stay tuned as we dive deeper into selecting the right platform, managing risks, and crafting your personalized trading strategy. It’s an exciting ride, and we’re just getting started!

Bank account

The most basic requirement is to have a bank account. A bank account will allow you to deposit and withdraw money. Having enough cash in your account to start trading is also essential.

Demat account

A Demat account is where you keep your shares in an electronic format. It turns the physical shares into an electronic form, dematerialized. When you open a Demat account, you will be given a Demat account number, which enables you to settle your trades electronically.

Choosing a Trading Platform

Now that you’ve grasped the basics, the next step is finding your trading platform. It’s like picking the right tool for the job. There are various brokerage options, from full-service to discount brokerages, each with perks. Then, there are online trading platforms - your gateway to the market. Exploring their features is crucial because finding the right fit makes your trading journey smoother.

Trading account

To be able to buy stocks, you'll need a stock trading account. That's because when a company publicly lists its shares on the stock market, you can trade them electronically using a specialized account called a stock trading account. Don't worry if you're confused about a demat and trading account. You can easily get such accounts by registering with a stock broker (Zerodha), India's No. 1 stockbroker. To open an account at a broker, you will need: -

- Aadhaar

- PAN Card

- Valid Email Address

- Mobile Number

- Bank Account

Device

A device is a piece of hardware that can be used to store data, make calculations, and process information. In stock market trading, a device is required to make trades with the brokerage account and monitor the performance of stocks. The hardware requirements depend on the type of trading one will do. For example, if one trades stocks, They'll require a device like laptop or desktop computer or smartphone or tablet capable of running Windows, Linux, or Mac and has a fast processor, at least 8GB of RAM, and at least 50 GB of free hard drive space.

Reliable internet connection

In today’s world, a reliable internet connection is essential for stock market trading. The stock market is a very competitive field, and traders need to be able to make decisions quickly. They need an internet connection that will not disconnect or slow down during trading.

The current state of the stock markets has led to a rise in the demand for reliable internet connections. Traders are more aware of the importance of a strong connection and are willing to pay more.

Understanding Risk Management

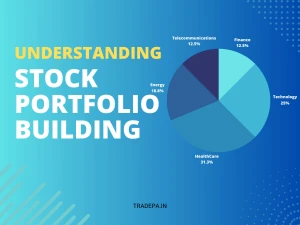

The stock market isn’t all sunshine and rainbows. There are storms too. Risk management becomes your shield. Assessing risks and tolerating them is like knowing when to take cover. Diversification spreads your investments, reducing the impact of a single loss, while stop-loss orders act as safety nets, preventing big hits to your portfolio.

Prepare for the upcoming sections, where we’ll delve into crafting your trading plan, exploring simulated trading, and the importance of continuous learning and research in your stock market journey. The road ahead is filled with opportunities, and with the proper knowledge, you’ll navigate it like a pro!

Developing a Trading Plan

Now that you know the basics, it's time to set your course. Your investment goals become the guiding stars in this journey. Crafting a personalized trading strategy is like plotting your route. Will you opt for short-term gains or aim for long-term stability? And when it comes to making decisions, will you lean on fundamental analysis, understanding a company's value, or delve into technical analysis, examining stock price movements?

Practicing with Simulated Trading

Before leaping into the live market, testing the waters first is wise. Simulated trading, akin to a flight simulator for pilots, allows you to practice without real risks. Exploring paper trading platforms lets you make mistakes without the financial bruises. Moreover, it's a great way to gain confidence and refine your strategies before playing with real money.

Continuous Learning and Research

In the ever-evolving world of stocks, learning never stops. We’ll point you toward resources that act as your compass. Books, podcasts, and online courses serve as valuable guides. Moreover, staying updated with market news and trends is like keeping your finger on the market’s pulse. The more you learn and stay informed, the better you are for the twists and turns ahead.

As we wrap up, remember this isn’t just about the destination but the journey. It’s about the learning, the growth, and the experiences along the way. So, with these tools in hand, let’s embark on this exhilarating stock market journey together!

Conclusion

Congratulations on reaching the end of this beginner’s guide to stock market trading! We’ve covered a lot of ground, from understanding the allure of trading to diving deep into the essentials. Let’s take a moment to recap the key points that form the foundation of your journey into the stock market.

Remember, the stock market isn’t just about making money - it’s about being part of something dynamic. However, it’s crucial to acknowledge that with great opportunities come risks. Understanding and managing these risks will be fundamental to your trading journey.

Setting the foundation involved learning about the stock market itself and the different types of stocks. It’s like learning the alphabet before reading a book; it’s essential.

Moving forward, the requirements for beginners focused on acquiring essential knowledge and ensuring financial readiness. These steps prepare you to take the plunge into the market confidently.

Choosing the right platform and opening a trading account is like laying the tracks for running your train smoothly. Comprehending risk management and crafting a trading plan act as your compass in the ever-changing landscape of stocks.

Practicing with simulated trading and continuously learning and researching are ongoing tools for growth and refinement.

Lastly, starting this journey isn’t just about reaching a destination; it’s about embracing the learning process, challenges, and victories. So, with these insights and knowledge, you’re now equipped to embark on your exciting stock market journey. Remember, every trade and every decision is a step forward in your learning experience. Happy trading!

Frequently Asked Questions

1. How do I start trading or investment in the stock market?

First, gather some basic knowledge about how stocks work. Then, decide how much money you want to start with and open an account with a brokerage firm.

2. How much money do I need to start trading?

You can start with any amount! Some start with a small sum and gradually invest more as they become comfortable.

3. Is stock market trading risky?

Like riding a bike, there are risks, but with practice and caution, it can be managed. Knowing when to invest and when to hold back is crucial.

4. What is risk management in stock market trading?

Managing risk is akin to putting on a seatbelt before driving. it’s about planning to protect your money. Things like spreading your investments and setting limits help manage risks.

5. Do I need a lot of knowledge to start trading in the stock market?

It’s good to have some basic knowledge. Understanding how stocks work and a few key terms will help you feel more confident. You can learn as you go too!

6. Where can I learn more about stock market trading?

There are many resources! Books, online courses, and even YouTube videos can teach you a lot. Also, some brokerage firms offer educational materials for beginners.

7. What should I consider before investing my money?

Firstly, clearly understand how much you can invest without impacting your everyday expenses. Having a budget and emergency savings set up is essential.

8. Are there any specific documents I need to start trading?

Yes, when opening a trading account, you’ll typically need identification documents, like a driver’s license or passport, and sometimes proof of address.

9. Is it possible to engage in stock trading without a brokerage account?

No, you’ll need a brokerage account to buy and sell stocks. It’s like needing a bank account to manage your money.

10. How can I learn about reading stock charts and interpreting data?

There are many online resources and tutorials available. Start with beginner-friendly guides on how to read stock charts.

11. Should I start with a cash account or a margin account?

For beginners, a cash account might be safer. It allows you to use only the money in your account to buy stocks, whereas a margin account involves borrowing money from the broker.

12. What if I make a mistake while trading?

Making mistakes is a part of learning. Start small, and if you make a mistake, take it as a lesson to improve your strategy.

13. Is stock market trading only for experts or can beginners succeed too?

Absolutely! Many successful traders started as beginners. Anyone can navigate the stock market effectively with dedication, learning, and patience.