Loan EMI Calculator

- Introduction

- What is an EMI Calculator?

- How Does an EMI Calculator Work?

- Advantages of Using a Loan EMI Calculator

- Types of Loans for Which EMI Calculators are Used

- Understanding EMI Calculation Formulae

- Benefits of an EMI Calculator in Financial Planning

- Common Mistakes to Avoid While Using an EMI Calculator

- Additional Tips for Efficient Loan Management

- Conclusion

Introduction

Understanding the nitty-gritty of repayments can be daunting when taking out a loan. Enter the Loan Equated Monthly Installment (EMI) Calculator—a tool that simplifies the complex world of loan repayments. Whether you're eyeing that dream car, planning a home purchase, or looking for a personal loan, comprehending how much you'll repay monthly is crucial. This article delves into the significance of Loan EMI Calculation and the perks of utilizing an EMI Calculator for your financial planning.

Importance of Loan EMI Calculation

Loan EMI Calculation isn't just about numbers; it's about empowerment. It gives you a clear picture of your financial commitments and aids in making informed decisions. Imagine applying for a loan without knowing how much you'll have to shell out monthly—that's like sailing blindfolded! EMI Calculation is your guiding light, clarifying the monthly installment amount and allowing you to gauge if it aligns with your budget and income. It's a fundamental aspect of responsible borrowing, ensuring you avoid taking on more than you can handle and helping you plan your expenses systematically.

Benefits of Using an EMI Calculator for Loans

The advantages of using an EMI Calculator extend beyond mere convenience:

- It's all about accuracy. This tool swiftly computes your EMI based on the loan amount, tenure, and interest rate, eliminating human errors and guesswork.

- It's a time-saver. Instead of manually crunching numbers or relying on estimations, you have a precise EMI figure at your fingertips within seconds.

- It's your comparison, buddy.

With an EMI Calculator, you can compare various loan options—adjusting loan amounts, tenure, or interest rates—to identify the most suitable plan that fits snugly into your financial landscape. Ultimately, it empowers you, making the loan borrowing process transparent and manageable.

Embracing the Loan EMI Calculator is not just about simplifying loan repayments; it's about taking charge of your financial journey. Understanding the significance of EMI Calculation and harnessing the benefits of an EMI Calculator sets the stage for informed decision-making and responsible financial planning.

What is an EMI Calculator?

An EMI Calculator is your financial ally, simplifying the intricate process of loan repayment planning. At its core, it's a digital tool designed to compute Equated Monthly Installments (EMIs) swiftly and accurately. Its functionality revolves around three key components: the loan amount, interest rate, and loan tenure.

Components of an EMI Calculator

- Loan Amount: The sum of amount you intend to borrow from a financial institution. This value forms the foundation of your loan and significantly impacts your EMI. A higher loan amount translates to higher EMIs, while a lower amount results in more manageable monthly payments.

- Interest Rate: The rate charged by the lender on the borrowed amount is expressed as a percentage. The interest rate directly influences the total interest payable over the loan tenure. Even a tiny change in this rate can significantly impact your EMI amount and the overall cost of the loan.

- Loan Tenure: The duration you'll repay the loan is typically measured in months or years. The loan tenure plays a pivotal role in determining your EMI. Choosing a shorter tenure increases the EMI but reduces the total interest paid, while a longer tenure lowers the monthly payment but leads to higher interest expenses.

- Moratorium period: It refers to a specific timeframe during which a borrower is allowed to temporarily postpone or reduce loan payments, typically the principal repayment. However, interest may still accrue during this period, depending on the loan agreement.

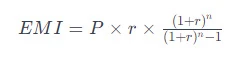

EMI Calculation Formula

The EMI (Equated Monthly Installment) calculation formula is derived from the standard formula for calculating the present value of a series of future payments (an annuity). The formula for EMI calculation is:

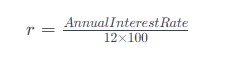

The monthly interest rate (r) is derived by dividing the annual interest rate by 12 and converting it into a decimal:

The formula calculates the fixed monthly payment (EMI) needed to pay off a loan amount, considering interest, over a specified period. Adjustments might be needed based on the compounding frequency (monthly, quarterly, etc.) and any additional fees or factors applicable to the loan.

How Does an EMI Calculator Work?

An EMI Calculator operates seamlessly to provide users with quick and accurate insights into their loan repayment structure. Understanding its workings involves a step-by-step breakdown, beginning with inputting loan details and culminating in generating an amortization schedule—a detailed table showcasing the loan repayment journey. Step-by-Step Guide to Using an EMI Calculator:

- Inputting Loan Details: Begin by entering the loan amount—the sum you intend to borrow. Follow this by inputting the interest rate the lender charges, expressed as a percentage. Then, indicate the loan tenure—the duration you plan to repay the loan in months or years. Finally, input a moratorium period (optional), a grace period where borrowers are not required to make repayments or pay a reduced amount initially. Accurate input of these details ensures precise EMI calculations.

- Calculating EMI: Once you've inputted the loan specifics and click on "Calculate" button, the Calculator swiftly crunches the numbers using the EMI calculation formula. It considers the principal amount, interest rate, and loan tenure to generate the Equated Monthly Installment. It also displays comprehensive repayment details, including a breakup of monthly installments into principal and interest components. This breakdown offers borrowers insights into how each payment contributes to reducing the principal loan amount and servicing the interest.

- Printing and Exporting as CSV File: After calculation, you will find "print" and "export as csv" button. This feature allows borrowers to keep a physical or digital record of their repayment schedule for future reference or analysis. Printing or exporting data in CSV format offers the flexibility to manipulate and organize repayment details as needed, aiding in better financial planning.

- Understanding Amortization Schedule: The EMI Calculator continues beyond computing the monthly installment. It generates an amortization schedule—an invaluable tool that breaks each EMI into its principal and interest components. This schedule details how much each payment reduces the principal loan amount and how much is attributed to paying off the interest. It's a roadmap of your repayment journey, clarifying outstanding balances, cumulative interest paid, and the loan's progress over time.

Advantages of Using a Loan EMI Calculator

- Accuracy in Estimation: One of the standout benefits of utilizing a Loan EMI Calculator is its capacity to offer precise and accurate estimations. This tool swiftly computes the Equated Monthly Installment (EMI) without room for human error or miscalculation by inputting the loan amount, interest rate, and tenure. This accuracy empowers borrowers by offering a clear and dependable insight into their monthly repayment commitments, eliminating surprises or uncertainties.

- Quick Comparison of Loan Options: In the financial landscape, choices abound regarding loan options—each with varying interest rates, tenures, and amounts. Here's where the EMI Calculator shines; it serves as your comparison compass. You can instantly evaluate and compare multiple loan scenarios by tweaking loan parameters—adjusting the loan amount, tenure, or interest rate. This feature allows borrowers to make informed decisions, identifying the most suitable loan option that aligns with their financial capabilities and goals.

- Planning Budgets Effectively: Effective financial planning hinges on the ability to anticipate and manage expenses. The EMI Calculator is pivotal in helping borrowers plan their budgets efficiently. Knowing the exact EMI amount aids in creating a realistic budget that accommodates monthly loan repayments. This foresight enables individuals to align their income and expenses accordingly, ensuring that loan repayments are seamlessly integrated into their financial plans without disrupting other essential financial commitments.

Types of Loans for Which EMI Calculators are Used

EMI Calculators cater to various loan types, aiding individuals in understanding and planning for their financial commitments across diverse aspects of life, from buying homes and cars to financing education or managing personal expenses. Understanding EMI calculations for these specific loan types empowers borrowers to make well-informed decisions aligned with their financial goals.

1. Home Loans:

EMI Calculators are widely utilized for home loans, which are substantial financial commitments for individuals purchasing property. These calculators help estimate the monthly repayments for home loans, considering the loan amount, interest rate, and tenure. With the substantial amounts involved in home loans, having a clear understanding of the EMI helps potential homeowners plan their finances effectively.

2. Car Loans:

Calculating EMIs for car loans is another common use of EMI Calculators. Whether buying a new or used car, these calculators estimate the monthly installment amount based on the loan amount (principal), interest rate, and repayment duration. This helps individuals budget and choose a car loan that fits comfortably within their financial capabilities.

3. Personal Loans:

Personal loans cater to diverse needs like funding weddings, travel, or handling emergencies. EMI Calculators assist individuals in understanding the repayment structure for personal loans. By inputting the loan amount, interest rate, and tenure, borrowers can gauge the monthly commitment, enabling better financial planning and decision-making.

4. Education Loans:

EMI Calculators are beneficial for those seeking financial aid for education. Education loans support students pursuing higher studies by covering tuition fees, living expenses, and other associated costs. Using an EMI Calculator, students and their families can estimate the monthly repayments, allowing them to plan their finances and choose a suitable loan option that aligns with their budget.

Understanding EMI Calculation Formulae

Understanding the nuances of EMI calculation formulae goes beyond mere number crunching; it empowers borrowers to make informed decisions about their loan preferences. Whether contemplating fixed or floating rates, assessing the impact of loan tenure, or considering various factors influencing EMI, a comprehensive understanding facilitates sound financial planning and prudent decision-making. EMI Calculators serve as indispensable tools in this journey, clarifying the intricacies of loan repayment structures.

1. Fixed vs. Floating Interest Rates:

EMI calculations differ based on the type of interest rates—fixed or floating. In a fixed-rate scenario, the interest rate remains constant throughout the loan tenure, ensuring predictable EMIs. Conversely, the interest rate in floating-rate loans fluctuates based on market conditions, leading to variable EMIs. EMI Calculators factor in these variations, offering insights into how different interest rate types impact monthly repayments.

2. Impact of Loan Tenure on EMI:

Loan tenure plays a pivotal role in EMI calculations. Choosing for a longer tenure reduces the monthly installment but increases the total interest paid over the loan's duration. Conversely, a shorter tenure escalates the EMI but decreases the overall interest payout. EMI Calculators illustrate these effects, allowing borrowers to fine-tune the loan tenure to suit their financial capabilities and preferences.

3. Factors Affecting EMI Calculation:

Several key factors influence EMI calculations beyond loan amount and tenure. These include the interest rate, which significantly impacts the EMI amount. Any prepayments or down payments made towards the loan can affect subsequent EMIs. Moreover, the loan's processing fees, administrative charges, and insurance costs can influence the overall EMI. EMI Calculators consider these variables, offering a holistic view of the loan repayment structure.

Benefits of an EMI Calculator in Financial Planning

EMI Calculators transcend mere loan repayment calculations and are potent instruments for strategic financial planning. Whether devising customized loan repayment strategies, understanding the impact of prepayments, or aligning loan commitments with other financial goals, these calculators empower individuals to navigate their financial journeys with precision and foresight.

Loan Repayment Strategies:

EMI Calculators serve as strategic tools for devising efficient loan repayment strategies. By utilizing these calculators, borrowers can explore diverse repayment scenarios. They can opt for accelerated payment schedules to repay the loan faster or choose a comfortable EMI that aligns with their financial situation. This flexibility empowers individuals to tailor their repayment strategy based on their financial goals and capabilities.

Impact of Prepayments on EMI and Loan Tenure:

Prepayments play a significant role in loan repayment, and EMI Calculators elucidate their impact on EMIs and loan tenure. Making additional payments towards the principal amount can reduce the outstanding balance, decreasing the overall interest payout. EMI Calculators help individuals comprehend how prepayments can alter the EMI or shorten the loan tenure, providing insights into optimizing loan repayment strategies.

Budgeting for Other Financial Goals:

One of the remarkable advantages of EMI Calculators lies in their ability to aid borrowers in effective budgeting for other financial goals. Individuals can allocate their resources more efficiently by accurately estimating and factoring the EMI into their monthly expenses. This allows for better management of discretionary spending, savings for other goals, and ensuring that loan repayments don't disrupt their ability to achieve other financial aspirations.

Common Mistakes to Avoid While Using an EMI Calculator

Avoiding these common mistakes is crucial for obtaining accurate and reliable estimates using an EMI Calculator. Ensuring the accuracy of loan details, accounting for all associated charges, and considering potential interest rate fluctuations are pivotal steps in making informed financial decisions regarding loan commitments.

I. Inputting Incorrect Loan Details:

One of the primary pitfalls when using an EMI Calculator is inputting incorrect loan details. Minor errors in entering the loan amount, interest rate, or tenure can lead to drastically different EMI calculations. It's crucial to double-check and ensure accuracy in these details to obtain precise repayment estimates.

II. Ignoring Additional Charges and Fees:

Sometimes, borrowers overlook additional loan charges, such as processing fees, administrative costs, or insurance premiums. If included while using an EMI Calculator, these expenses can result in accurate EMI calculations. Including all relevant charges is essential to understand the total repayment amount comprehensively.

III. Not Considering Interest Rate Fluctuations:

Interest rates in certain loan types, especially those with floating interest rates, are subject to fluctuations based on market conditions. Failing to consider potential interest rate changes while using an EMI Calculator may lead to inaccurate estimations of future EMIs. It's prudent to factor in potential interest rate variations or use conservative estimates to prepare for repayment fluctuations.

Additional Tips for Efficient Loan Management

Efficient loan management goes beyond EMI calculations. Understanding loan terms, seeking expert advice, and staying vigilant about interest rate variations are essential to ensure smooth loan repayments and manage finances effectively. These practices empower individuals to navigate the loan landscape with confidence and foresight.

1. Understanding Terms and Conditions:

It's crucial to thoroughly comprehend the terms and conditions of any loan agreement before signing. Pay close attention to details regarding interest rates, prepayment penalties, late fees, and other clauses that might impact the loan repayment. Utilize resources such as loan agreements and official documentation, or consult with the lender to clarify all aspects of the loan.

2. Seeking Professional Advice:

Seeking guidance from financial advisors or loan experts can provide valuable insights and personalized recommendations. Professionals can assist in evaluating loan options, understanding complex financial terms, and devising effective repayment strategies tailored to individual financial situations. Their expertise can be priceless when it comes to making well-informed decisions.

3. Tracking Changes in Interest Rates:

Interest rates can significantly impact loan repayments. Regularly monitor and stay updated on changes in interest rates, especially for loans with floating interest rates. Monitor economic indicators or notifications from financial institutions to anticipate potential fluctuations. Being aware of these changes helps in planning and adjusting repayment strategies accordingly.

Conclusion

In the borrowing and financial planning realm, the Loan EMI Calculator emerges as a beacon of empowerment, simplifying the intricate landscape of loan repayments. It transcends mere number crunching, offering borrowers a panoramic view of their financial commitments and possibilities.

From understanding the significance of EMI calculations to harnessing the benefits of EMI Calculators, this tool serves as a cornerstone for responsible borrowing and informed decision-making. Its estimation accuracy, ability to facilitate comparisons, and aid in effective budgeting render it indispensable in the loan borrowing process.

Furthermore, comprehending the nuances of EMI calculation formulae, avoiding common mistakes, and choosing between online and offline tools provide individuals with the tools and knowledge to navigate the complexities of loans confidently.

Efficient loan management extends beyond calculations, encompassing a holistic approach involving understanding terms, seeking expert advice, and vigilance about interest rate fluctuations. By embracing these practices, borrowers can chart a course toward financial stability and achieve their goals without being overwhelmed by loan obligations.

In essence, the Loan EMI Calculator isn't just a digital tool; it's a companion in the financial journey, providing clarity, insights, and the confidence to navigate the intricate terrain of loans, ensuring that financial goals are not just dreams but tangible realities.