Choosing the Best Broker Platform

Introduction

Welcome to the world of trading! As you embark on this exhilarating financial journey, one of the pivotal decisions you’ll make is selecting the right broker platform. It might sound daunting, but trust me, it’s like finding the ideal match for your favorite pair of shoes – once you get it right, you’re all set for a comfortable stroll through the markets.

Why it is Important to Choosing the Right Broker Platform

Picture this: You’re about to start a grand adventure, and the backpack you choose will carry all your essentials. Well, consider the broker platform as that crucial backpack for your investments. It’s not just a platform; it’s your partner in navigating the markets, executing trades, and making your financial dreams a reality. Choosing the right one means smoother sailing and fewer headaches along the way.

Impact of Broker Choice on Investments

Here’s the real game-changer: your broker choice can significantly affect how your investments fare. It’s like choosing the suitable soil for your garden; a good platform provides the fertile ground where your investments can grow and thrive. Every aspect of your chosen broker can influence your investment journey, from fees to available tools and resources. So, making a wise choice here can set the stage for successful trades and a prosperous portfolio.

Types of Broker Platforms

When it comes to broker platforms, It’s like trying to decide between various flavors of ice cream – each has its unique taste and suits different preferences. Here’s a breakdown of the primary types you’ll encounter:

- Full-Service Broker: Think of full-service brokers as the all-inclusive resorts of the trading world. They offer various services, from investment advice to research reports and portfolio management. Their target audience often includes investors seeking personalized guidance and comprehensive support. While they come with a fuller package, it’s important to note that these services often come at a higher cost.

- Discount Broker: If you’re looking for a more budget-friendly option, discount brokers might be your go-to. They’re like the no-frills airlines – cost-efficient and practical. These platforms offer trading services at lower commissions but with fewer bells and whistles. They’re ideal for self-directed investors who prefer making decisions and are comfortable with minimal assistance.

- Robo-Advisors: Enter the future of investing – robo-advisors! These platforms harness the power of automation and algorithms to manage your investments. Picture a digital financial advisor constantly analyzing data and deciding on your preferences. They offer personalized strategies and support but operate with minimal human intervention, making them cost-effective and attractive for hands-off investors.

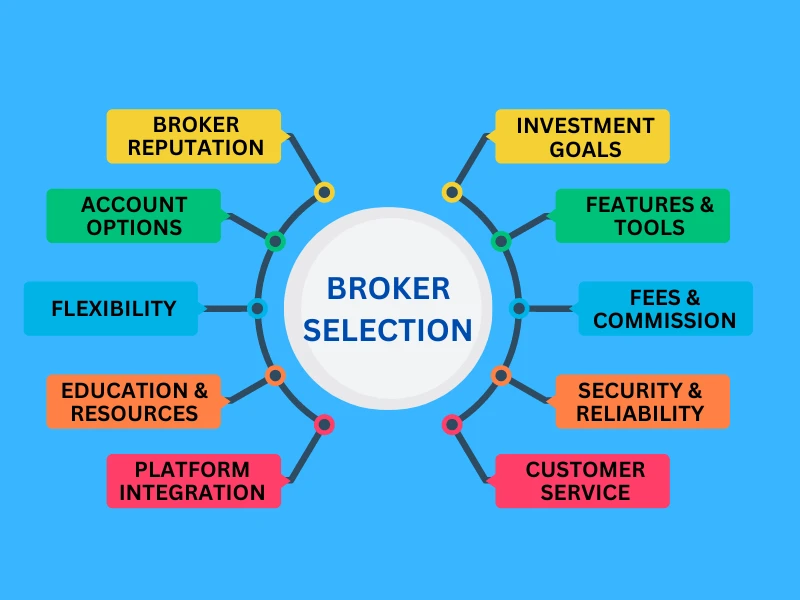

Key Considerations in Broker Selection

Choosing a broker platform is like picking the right tools for a DIY project – it’s all about finding what works best for you. Let’s break down the key considerations to ensure you have the proper knowledge before making that all-important decision.

1. Assessing Your Investment Goals and Style

First things first: let’s understand your financial game plan. Are you aiming for short-term wins or playing the long game? It’s like deciding whether to sprint or run a marathon. Also, are you keen on actively managing your trades or leaning towards a more hands-off approach? Your answers here will help align your choice with what suits your style and objectives best.

2. Platform Features and Tools

Imagine you’re picking out a smartphone – you’d want one that’s user-friendly, packed with helpful apps, and easy to navigate, right? Similarly, consider the user interface when choosing a broker platform – is it intuitive? Plus, check out the tools available for research and analysis. Having access to reliable tools is crucial for making informed investment decisions. Oh, and don’t forget mobile accessibility – because, let’s face it, life happens on the go!

3. Fees and Commissions

People generally dislike unexpected expenses, particularly those that are associated with fees. Look closely at the commission structures or brokerage charges – some platforms charge per trade, while others offer flat rates. And watch out for those sneaky hidden fees; they can pop up when you least expect them. Being aware of these costs upfront ensures that what you gain from your trades doesn’t get eaten away by hefty charges.

4. Security and Reliability

When choosing a broker platform, ensuring your investments are safe is crucial. Here’s what you need to consider:

- Regulatory Compliance and Safety Measures: Understanding the regulatory landscape is like checking the safety certifications before buying a new car – it’s about ensuring the platform meets the necessary standards. Take the time to know the regulatory bodies governing the platform. Look for terms like SEC or FINRA in the US or FCA in the UK. Additionally, check out their security protocols and insurance coverage – you want your investments protected against unforeseen circumstances.

- Platform Reliability and Uptime: Reliability is critical; you wouldn’t want your favorite streaming service crashing mid-movie. Similarly, consider the platform’s historical performance – has it faced frequent downtimes or glitches? Additionally, look into their backup and recovery measures. Knowing they have a plan to safeguard your trades and data in case of technical hiccups can provide peace of mind.

5. Customer Service and Support

When it comes to your investments, having reliable support is critical. Here’s what to consider:

- Availability and Responsiveness: Think of customer support as your safety net in the trading world. Look for platforms that offer responsive support. Consider whether they provide live support from human agents or rely on automated systems. Also, check out their community and educational resources. A platform that offers a supportive community and educational materials can empower you with the knowledge needed to make informed decisions.

- Handling of Issues and Resolutions: Problems can arise, and how the platform handles them matters. Inquire about their problem resolution timelines – how quickly do they address issues? Additionally, delve into their customer feedback and reputation. What are other users saying about their experiences? A platform with a strong track record for swiftly addressing concerns and maintaining a positive reputation among users indicates reliable customer service.

6. Evaluating Broker Reputation and Track Record

Understanding a broker platform’s reputation is akin to vetting a potential business partner – you want reliability and trustworthiness. Here’s how to assess it:

- Reviews and Testimonials: Reviews and testimonials act as your guideposts in the decision-making process. Explore online reviews and ratings of the broker platform. Look beyond the stars and delve into what users appreciate or critique. Additionally, seek out personal experiences shared by investors. Listening to personal experiences can offer a significant understanding of the platform’s effectiveness and its users’ satisfaction.

- Longevity and Industry Standing: A company’s history often speaks volumes about its reliability. Look into the broker’s longevity and stability. How long have they been in the business, and what milestones have they achieved? Furthermore, examine their track record in client satisfaction. Have they consistently met or exceeded their client’s expectations? A broker platform with a solid history and a proven record in satisfying its clientele will likely be a trustworthy partner for your investments.

7. Account Options and Flexibility

Navigating the Indian investment landscape requires understanding the account options and investment choices available. Here’s what to consider:

- Account Types Offered: Broker platforms typically offer various account types tailored to different needs. Look into individual accounts, joint accounts for shared investments, and retirement accounts such as the National Pension System (NPS) or the Public Provident Fund (PPF). Moreover, platforms might also provide specialized accounts like trading accounts for derivatives or commodities. Understanding these options helps you align your investments with your financial goals effectively.

- Flexibility in Investment Choices: Regarding investment choices, a robust platform in India should offer a diverse array. Check if they provide access to various investment vehicles like stocks, bonds, mutual funds, and Exchange-Traded Funds (ETFs). Additionally, consider their offerings for international investment opportunities, such as Global Depository Receipts (GDRs) or international mutual funds. A versatile platform offering a variety of investment options lets you diversify your portfolio, balancing risk and potential returns.

8. Education and Resources

Access to educational materials and market insights is invaluable for making informed investment decisions. Here’s what to look for:

- Learning Materials and Tools: A robust broker platform offers a treasure trove of learning resources. Look for platforms that provide diverse learning materials like webinars, tutorials, and courses on investment strategies, market analysis, and trading techniques. Additionally, seek platforms offering comprehensive investment guides and regular news updates. These resources empower you with the knowledge needed to navigate the markets confidently.

- Market Analysis and Insights: Market analysis can be overwhelming, but a good platform simplifies it. Check if the platform provides access to expert commentary – insights from seasoned professionals can be enlightening. Moreover, look for access to research reports and publications that offer in-depth analysis of market trends and specific sectors. A platform that equips you with actionable insights and a deeper understanding of market dynamics is a valuable asset in your investment journey.

9. Platform Integration and Additional Services

Integrating various financial services and additional offerings can significantly enhance your trading experience. Here’s what to consider:

- Integration with Other Financial Services: Seek platforms that seamlessly integrate with other financial services. Look for integration with banking and payment services – a platform that allows easy transfers and direct linking to your bank accounts and simplifies fund management. Additionally, consider platforms that offer portfolio management tools. Integrated tools that help you track, analyze, and manage your investments efficiently can be a game-changer.

- Additional Services Offered: Beyond trading, look for platforms that offer supplementary services. Tax planning and reporting services can be highly beneficial – platforms that assist in tax calculations and provide reporting tools streamline your tax-related responsibilities. Moreover, some platforms offer investment advisory services. These services provide personalized guidance and recommendations from financial experts, which can be invaluable for making strategic investment decisions.

Conclusion

As you navigate the landscape of broker platforms, here’s a recap and some final thoughts to help you make a well-informed choice:

Remember, choosing a broker platform is akin to finding the perfect fit for your investment journey. Consider your investment goals, platform features, fees, regulatory compliance, customer service, and more. These key considerations ensure the platform aligns with your unique financial objectives and preferences.

Armed with the knowledge gained from evaluating various aspects of broker platforms, you’re better equipped to make an informed choice. When searching for a platform, ensure it aligns with your investment style, offers necessary tools and support, and prioritizes security and reliability.

Broker platforms serve as your gateway to the financial markets. Remember, there’s no one-size-fits-all platform; the right choice depends on your needs and goals. By carefully considering the factors we’ve discussed, you can confidently select a platform that sets the stage for a successful and fulfilling investment journey.