Long-Term vs Short-Term Investing Strategies

Introduction

Investing can initially seem like a maze of numbers and jargon, but it’s putting your money to work to make more money. Investing is a smart move whether you’re thinking of growing your savings or planning for the future. But here’s the thing: not all investing strategies are the same. Picking the right one is like choosing the right tool for the job—it can make a huge difference in what you get from it. That’s where the long-term versus short-term debate comes in. It’s like deciding between a sprint and a marathon in investing. Let’s dive in and figure out which strategy might work best for you.

Understanding Long-Term Investing

Long-term investing is like planting seeds for a bountiful garden rather than seeking quick harvests. It’s about holding onto investments for an extended period, often years or even decades, allowing them to grow steadily over time. This patient approach focuses on the long game, prioritizing stability and enduring growth over immediate profits. Characteristics of long-term investing include a commitment to weathering market fluctuations and a belief in the power of time to amplify returns.

Looking back in history, there are inspiring stories of successful long-term investors who embraced this patient approach. Icons like Warren Buffett and Benjamin Graham exemplify the wisdom of holding investments for the long haul. Their strategies involved picking solid companies and staying invested in them through market ups and downs, reaping substantial rewards over time. These historical figures showcase how adopting a long-term mindset can lead to significant wealth accumulation.

The benefits of a long-term approach are profound, especially for beginners in the investing world. It’s not just about making money; it’s about making more intelligent decisions that stand the test of time. Long-term investing offers the advantage of allowing compound interest to work its magic. As your investments grow, they start earning money on their own, creating a snowball effect that can significantly boost your wealth. Moreover, this approach allows investment time to recover from market downturns, emphasizing resilience and steady progress over quick, risky maneuvers.

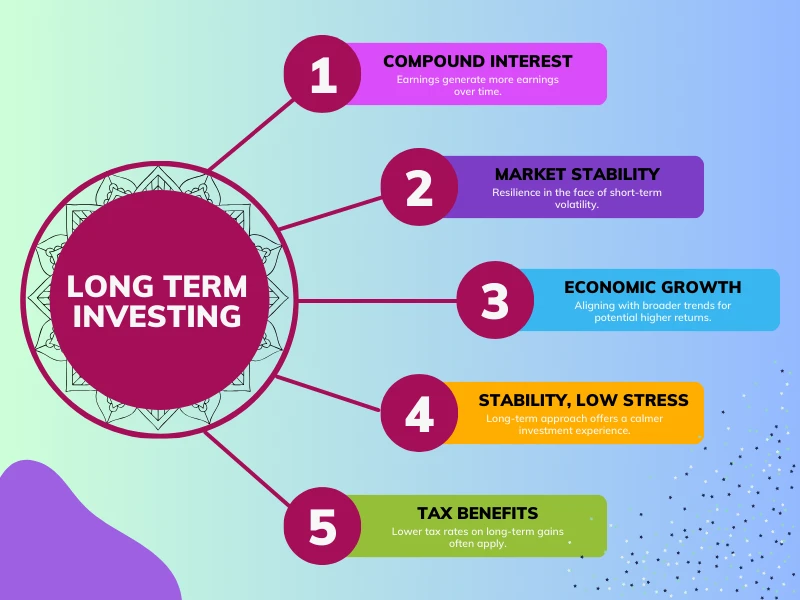

Advantages of Long-Term Investing

- Compound Interest Magic: Allows your money to generate earnings, earning their returns and exponentially growing your investments.

- Weathering Market Volatility: Long-term investors stay steady during market fluctuations, avoiding knee-jerk reactions and benefiting from the market’s upward trend.

- Capitalizing on Economic Growth: Aligns investments with broader economic growth trends, ensuring potential gains from the overall advancement of economies and industries.

- Lower Stress, Higher Stability: Offers a less stressful investment experience, fostering patience and stability over quick but potentially risky gains.

- Tax Benefits: Often involves lower tax rates on long-term gains compared to short-term investments, potentially enhancing overall returns.

One of the most fantastic things about long-term investing is compound interest. Let me explain: when you invest, your money earns interest. With compound interest, that interest then earns its interest and keeps growing over time. It’s like a snowball rolling down a hill, getting more extensive. The longer you leave your money to grow, the more it can earn. This compounding effect can substantially amplify your returns in the long run.

Another perk of long-term investing is that it’s like wearing a sturdy raincoat in a storm. Markets go up and down like a rollercoaster, and short-term investors might freak out and bail when things get shaky. But long-term investors? They’re like, “It’s all good; I’m here for the long haul.” They’re better equipped to ride out those market waves without panicking because they focus on the bigger picture. They understand that markets bounce back over time, and they stay in for the potential rewards, waiting on the other side.

Also, with long-term investing, you can ride the wave of economic growth. Think about it: economies grow over time, new technologies emerge, and companies evolve. Long-term investors get to benefit from these overall trends. They’re not just chasing short-lived market highs; they’re in it for the long run, tapping into the broader growth of the economy. This way, they align their investments with the more significant movements in the financial world, which can lead to more sustainable and substantial returns.

Challenges and Considerations in Long-Term Investing

Patience truly becomes a prized asset in the realm of long-term investing. It’s like waiting for your favorite plant to bloom—it takes time, care, and a lot of patience. Long-term investors need to understand that the real gains often come slowly over time rather than overnight. It’s about resisting the urge to tinker with investments in pursuit of quick wins constantly and instead trusting the long-term vision.

Now, let’s talk about risk. Long-term investing isn’t risk-free. There are moments when the market might take a dip, and your investments might shrink temporarily. But here’s the catch: these investors often have strategies to manage these risks. Diversification—spreading your investments across different assets—helps cushion the impact of market downturns. It’s like not putting all your eggs in one basket; if one investment takes a hit, the others can balance it out.

Additionally, sticking to the same investment plan without adjustments isn’t always the best idea. Long-term investors also need to reassess and tweak their strategies periodically. Life changes, economies evolve, and what worked ten years ago might not work the same today. This means occasionally rebalancing your portfolio—adjusting your investments to match your current financial goals and the changing market landscape. It’s like fine-tuning an instrument to keep it playing in harmony.

Exploring Short-Term Investing

Short-term investing is like sprinting rather than taking a leisurely walk—it’s all about quick gains over a shorter period. In this approach, investors buy and sell assets within a short timeframe, aiming to profit from market fluctuations or short-lived opportunities. It’s like catching waves in the market, looking for quick rises and falls to make money fast.

There are a couple of flavors to short-term investing: -

- Day trading: Also known as intraday trading. Buying and selling assets on the same day. It’s fast-paced, requiring constant attention to market movements and making multiple trades in a single day.

- Short-term trading: where investors might hold assets for a few days, weeks, or months but still aim for swift profits compared to the long-term approach.

Short-term strategies come with their own set of pros and cons. The upside? Quick profits, potentially higher returns in a shorter period, and the ability to capitalize on short-term market movements. It can be exhilarating and profitable if you’re good at analyzing short-term trends and have the time and dedication. But here’s the downside: it’s high-risk and high-stress. Market volatility can lead to rapid losses, and it requires constant attention. Plus, there’s the pressure to time the market just right, which is not easy and can sometimes lead to losses rather than gains. Short-term strategies might suit some investors but come with a rollercoaster ride of risks and rewards.

Risks and Rewards of Short-Term Investing

Short-term investing is like a rollercoaster ride — it’s thrilling but comes with ups and downs that happen quickly. One of the big draws is the potential for quick gains. Since short-term investors buy and sell rapidly, they might snag profits in a short span. But here’s the flip side: those gains can vanish just as fast. Market volatility in the short term means that what goes up can also come crashing down swiftly, leading to rapid losses.

Timing the market is critical in short-term investing, and that’s easier said than done. It’s like trying to catch a falling leaf—it’s tough to predict precisely when it’ll hit the ground. Short-term investors need to be on their toes, analyzing trends, news, and market movements constantly to make split-second decisions. However, the challenge lies in the unpredictability of markets, making it tricky to time buys and sells perfectly.

Another thing to watch out for with short-term investing is the tax implications. Tax rates for short-term gains can be higher than long-term gains in many places. If you hold onto your investments for less than a year in some countries, you might face steeper taxes on any profits you make. This aspect eats into your gains and can significantly impact your overall returns, making it essential to consider tax implications when opting for short-term strategies.

Psychology of Long-Term vs. Short-Term Investing

| Aspect | Long-Term Investing | Short-Term Investing |

|---|---|---|

| Emotional Factors | Emphasizes patience and enduring focus. | Often influenced by immediate gains or losses. |

| Impact of Market Volatility | Focuses on riding out market fluctuations calmly. | Prone to reacting impulsively to rapid market changes. |

| Developing a Disciplined Mindset | Encourages steady, disciplined investment plans. | Requires quick decision-making and adaptability. |

Emotions play a huge role in investing—whether it’s the excitement of quick gains or the fear of sudden losses. In short-term investing, emotions can run high because everything happens so quickly. Investors might feel pressured to make rapid decisions, leading to emotional impulses dictating their actions. Fear, greed, and impatience often influence short-term choices, potentially leading to irrational decisions driven by emotions rather than sound strategies.

Market volatility, especially in the short term, can push emotions on a rollercoaster. When prices swing wildly, it can trigger panic or over-excitement, causing investors to react impulsively. This volatility can make short-term investors feel like they’re on an emotional rollercoaster, affecting their judgment and causing them to buy or sell based on emotions rather than logic.

Developing a disciplined mindset is crucial, especially in the whirlwind of short-term investing. Long-term investors tend to have this down pat—like the Zen investing masters. They have a plan, stick to it, and don’t let emotions hijack their decisions. It’s about having the discipline to stay calm amidst market chaos, sticking to a well-thought-out strategy, and not getting swayed by momentary market jitters. Developing this disciplined mindset takes time and practice, but it’s a valuable skill that can help investors make more rational and informed choices.

Building a Long-Term Portfolio

Creating a long-term portfolio is like building a sturdy house, requiring a solid foundation and thoughtful planning. Diversification is a key strategy in this process. It’s a bit like not putting all your eggs in one basket. You reduce the risk by spreading your investments across different types of assets—like stocks, bonds, and real estate. If one investment doesn’t do well, the others can balance it out, helping to cushion the impact of market fluctuations.

Choosing solid and stable investments is crucial for long-term success. Think of it as picking the right ingredients for a recipe—quality matters. Look for companies or assets with strong track records or strong fundamental, solid financial health, and a promising outlook for the future. It’s not about chasing quick gains but investing in entities with a good chance of growing steadily.

Aligning your investments with your financial objectives is like plotting a course for a journey—you need to know where you’re going. Whether saving for retirement, buying a house, or funding education, your investments should support these goals. It’s crucial to grasp your risk tolerance and time horizon. You might take on a bit more risk for potentially higher returns for long-term goals, while short-term goals might require safer, more stable investments. Crafting a portfolio that syncs with your objectives is fundamental to long-term investment success.

Strategies for Short-Term Success

- Technical Analysis & Chart Patterns: Use past data and market indicators to predict short-term trends and potential buying/selling points.

- Research Short-Term Opportunities: Regularly conduct in-depth research on market movements, news, and financial reports to identify short-term openings.

- Set Realistic Short-Term Goals: Establish achievable objectives aligned with short-term investment timelines, ensuring focus and clarity in decision-making.

Short-term success in investing often involves employing specific strategies tailored to the rapid pace of the market. Technical analysis and chart patterns are tools in a short-term investor’s toolbox. It’s about studying past market data, like price movements and trade volume, to predict future price trends. Investors analyze charts and patterns to spot potential opportunities, looking for indicators that might signal when to buy or sell. It’s a bit like reading the signs along the road to guide your journey.

Research is the name of the game for short-term investors. They’re like detectives hunting for clues. Constantly scouring news, financial reports, and market trends helps identify short-term opportunities. Staying informed is crucial, whether it’s a company’s quarterly earnings report or a sudden market trend. Researching helps short-term investors make more informed and calculated decisions amidst the fast-paced market environment.

Setting realistic short-term goals is vital. It’s like marking checkpoints along a race. Short-term investors should have clear, achievable objectives, whether aiming for a certain profit percentage within a few days or weeks or targeting specific price points. These goals provide a roadmap and help investors stay focused amid the flurry of short-term market movements. Keeping goals realistic and achievable is key to managing expectations and reducing the pressure to make risky moves for quick gains.

Choosing the Right Approach for You

To navigate the investing world successfully, it’s crucial to tailor your approach to your circumstances and aspirations. To begin with, it’s essential to evaluate your risk tolerance and financial objectives. Risk tolerance is like your comfort level with the ups and downs of investing. Some people are okay with taking more significant risks in pursuit of possibly increased returns, while others prefer a more stable, low-risk approach. Understanding your comfort zone helps in choosing the right investment strategy.

Balancing long-term stability with short-term gains is like finding equilibrium on a seesaw. Long-term stability might suit those aiming for steady, predictable growth over time. On the other hand, short-term gains might attract those seeking quicker, albeit riskier, profits. It’s about finding the sweet spot that aligns with your goals—a mix that offers stability while allowing for some short-term gains.

For some investors, a hybrid strategy might be the best fit. It’s like having the best of both worlds—a blend of long-term stability and short-term opportunities. This strategy involves diversifying your investments, dedicating a portion to long-term assets for steady growth and another to short-term endeavors for quicker profits. It allows for flexibility and potential growth while managing risks. Creating a hybrid strategy can offer a middle ground for investors who don’t want to commit fully to the long-term or short-term approach.

Conclusion

In the journey of understanding investing strategies, it’s essential to remember a few key takeaways. Long-term investing focuses on patience and steady growth, harnessing the power of time and compound interest. On the other hand, short-term strategies aim for quick gains, relying on rapid market movements.

However, your chosen path should align with your goals and comfort level. Assess your risk tolerance and financial aspirations to determine the best fit. Remember, it’s not a one-size-fits-all scenario—find what suits you best.

Always do your homework. Research, study market trends, and stay informed. This knowledge equips you to make smarter investment choices. And when in doubt, consulting financial experts can provide invaluable guidance tailored to your needs.

Empower yourself to make informed decisions. Investing isn’t just about growing your money; it’s about making thoughtful choices that align with your life goals. So, whether you opt for the patience of long-term investing or the excitement of short-term strategies, ensure your path is paved with knowledge and confidence. Your financial journey is in your hands—make it a well-informed and rewarding one.