Active vs Passive Investing: Which is Right for You?

Introduction

Investing plays a vital role in personal finance, offering a way to grow wealth over time. Among the various investment strategies, two main approaches are active and passive. Active investing involves frequently buying and selling securities to outperform the market. This strategy relies on the investor's or fund manager's expertise to make investment decisions based on market research, trends, and economic data. On the other hand, passive investing focuses on a long-term approach, seeking to replicate the performance of specific market indexes.

Choosing the right investment approach is vital for achieving financial goals and maintaining peace of mind. It depends on several factors, including individual financial objectives, risk tolerance, investment horizon, and personal preferences. For instance, active investing may appeal to those who enjoy the challenge of managing their portfolios and believe they can outperform the market through skill and analysis. Conversely, passive investing might be more suitable for those who prefer a hands-off approach with lower costs and diversification benefits.

Choosing the right investment strategy impacts the overall performance of an investment portfolio. While potentially offering higher returns, active investing comes with higher risks and costs, including management fees and transaction expenses. Passive investing, known for its lower fees and consistent performance, may provide more stable returns over the long term. Understanding these differences and how they align with one's financial situation is essential for making informed investment decisions. Therefore, assessing both strategies thoroughly can lead to a more tailored and effective investment plan.

What is Active Investing?

Active investing involves frequent buy-and-sell decisions based on market research, economic indicators, and other relevant information. Active investors believe they can use short-term price fluctuations to achieve higher returns than those typically available through passive investing strategies.

Active investing is typically managed by individuals or professional fund managers who dedicate significant time and resources to analyze market trends and company performance. They use various tools and techniques to make informed investment decisions, including fundamental analysis, technical analysis, and macroeconomic research.

Popular Examples of Active Investing Strategies

Active investing encompasses various strategies, each with its unique approach and focus. One popular strategy is stock picking, where investors select stocks that will outperform the market. This approach requires in-depth research and analysis of company fundamentals, industry trends, and economic conditions. Another common strategy is market timing, where investors attempt to predict market movements and make trades accordingly. This method analyses historical data, market indicators, and economic forecasts to determine the best times to enter or exit positions.

Hedge funds represent another well-known example of active investing. These funds employ a range of sophisticated strategies, including long-short equity, event-driven, and global macro, to generate high returns for their investors. Hedge fund managers often use leverage and derivatives to enhance returns, making this a high-risk, high-reward investment approach. Additionally, mutual funds with active management aim to outperform specific indexes by employing professional fund managers to select and trade securities based on extensive research and market analysis.

What is Passive Investing?

Passive investing aims to generate returns that reflect the overall performance of a market index or benchmark. Unlike active investing, which involves frequent trading and attempts to outperform the market, passive investing focuses on a long-term approach with minimal trading. The primary objective is to achieve market-average returns by investing in a diversified portfolio replicating a market index's components, such as the S&P 500 or the FTSE 100.

Passive investors believe that the market efficiently prices securities, and therefore, trying to beat the market through stock picking and market timing is unlikely to yield better returns over the long term.

Passive investing is typically characterized by a buy-and-hold strategy, where investors purchase a diversified mix of assets and hold them for an extended period, regardless of market fluctuations. This approach reduces the need for constant monitoring and trading, resulting in lower costs and less time commitment for the investor. Over time, passive investing has become increasingly popular due to its simplicity, cost-efficiency, and consistent performance.

Popular Examples of Passive Investing Strategies

One of the most common passive investing strategies is investing in index funds. This strategy provides broad market exposure, low operating expenses, and low portfolio turnover.

Another popular passive investing strategy is using exchange-traded funds (ETFs). ETFs function similarly to index funds but are traded on stock exchanges like individual stocks. This allows for greater flexibility in buying and selling and the potential for tax efficiencies. ETFs cover various asset classes, sectors, and regions, enabling investors to easily build a diversified portfolio that aligns with their investment goals.

Difference Between Active and Passive Investing

| CHARACTERISTIC | ACTIVE INVESTING | PASSIVE INVESTING |

|---|---|---|

| Trading Frequency | Frequent buying and selling of securities | Minimal trading, buy-and-hold strategy |

| Cost | Higher costs due to management fees and transaction expenses | Lower costs due to reduced trading and management fees |

| Market Research | Extensive research and analysis to identify investment opportunities | Minimal research, focus on tracking market indexes |

| Management Style | Hands-on, requires active decision-making | Hands-off, replicates market performance |

| Risk Management | Employs various strategies including diversification and hedging | Diversification through broad market exposure |

| Performance Goal | Aim to outperform market benchmarks | Aim to match market index performance |

| Time Commitment | High, requires continuous monitoring and analysis | Low, requires minimal ongoing management |

| Volatility | Potentially higher due to frequent trading and market timing | Typically lower, aligns with overall market volatility |

| Return Potential | Potential for higher returns but with higher risk | More stable, consistent returns in line with market performance |

| Investor Suitability | Suitable for those with high risk tolerance and market expertise | Suitable for those seeking long-term growth with lower risk |

Which Strategy is Right for You?

Assessing Your Financial Goals and Timeline

Choosing between active and passive investing starts with clearly understanding your financial goals and investment timeline. Are you saving for a short-term goal, like a down payment on a house, or are you investing for long-term objectives, such as retirement? Active investing might be suitable if you aim to achieve higher returns in a shorter timeframe. On the other hand, if you have long-term goals, passive investing offers a more stable and hands-off approach, allowing you to benefit from market growth over time.

If you have a longer horizon, the compounding benefits of a passive strategy can lead to substantial growth with minimal effort. Conversely, a shorter timeline might necessitate a more aggressive approach to achieve the desired returns, where active investing could come into play.

Understanding Your Risk Tolerance

Risk tolerance is another critical factor in deciding between active and passive investing. Active investing typically involves higher risk due to frequent trading and attempts to outperform the market. It might appeal if you are comfortable with volatility and have a higher risk appetite.

In contrast, passive investing generally involves lower risk, focusing on long-term market performance rather than short-term gains. This strategy can be more suitable for investors who prefer a steadier, more predictable growth path and are uncomfortable with the high risks of active trading.

The Importance of Regular Portfolio Reviews

Regular portfolio reviews are essential regardless of whether you choose active or passive investing. These reviews help ensure that your investments align with your financial goals and risk tolerance. For active investors, frequent portfolio reviews are necessary. This continuous monitoring helps identify opportunities and mitigate risks, which is crucial for achieving the desired returns.

For passive investors, portfolio reviews, while less frequent, are still important. Over time, market movements can cause your portfolio to drift from its original allocation, affecting your risk profile and performance. Regular reviews allow you to rebalance your portfolio, ensuring it stays aligned with your investment goals. Additionally, as your financial situation and objectives change, periodic reviews help you make necessary adjustments to your strategy, ensuring it remains relevant and practical.

Combining Active and Passive Strategies

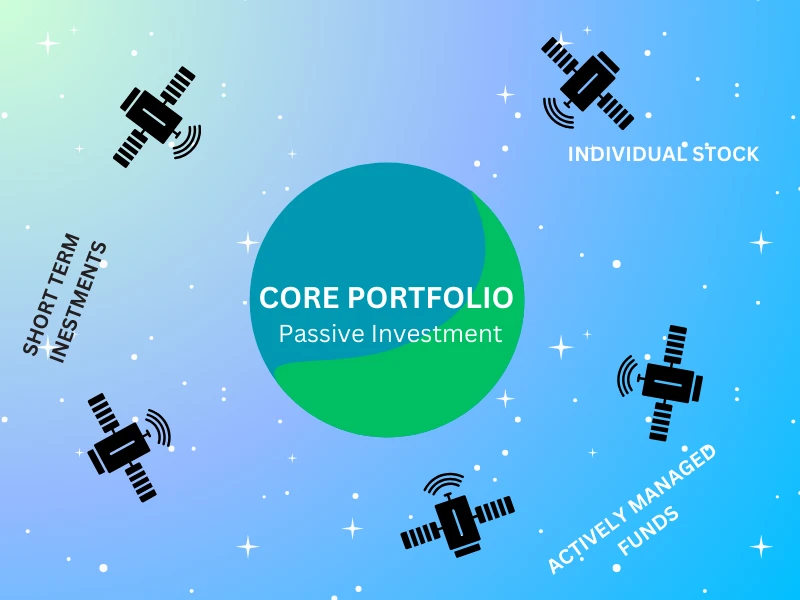

The Core-Satellite Approach

One effective method to combine active and passive investing is the core-satellite approach. This strategy involves building a stable, diversified "core" portion of your portfolio using passive investments, such as index funds or ETFs. The core is designed to provide broad market exposure and consistent, long-term returns with low costs and minimal management. This foundational part of the portfolio helps to ensure steady growth and reduce overall risk.

Around this core, you add "satellites" – smaller, actively managed investments to enhance returns or take advantage of specific market opportunities. These satellites might include individual stocks, actively managed mutual funds or sector-specific ETFs. The idea is to use these active investments to outperform the market and add value to the overall portfolio. Limiting the portion of your portfolio dedicated to active investments allows you to manage risk while still seeking higher returns.

Benefits of a Hybrid Strategy

Combining active and passive strategies offers several advantages:

- Diversification: The core-satellite approach provides a well-rounded portfolio by combining passive investments' stability with active ones' growth potential. This diversification helps manage risk and improve overall returns.

- Cost Efficiency: By keeping the core of your portfolio in low-cost passive funds, you reduce overall investment expenses.

- Flexibility: A hybrid strategy offers the flexibility to adapt to changing market conditions. You can adjust the active portion of your portfolio to capitalize on emerging trends or sectors, while the passive core provides a solid foundation.

- Risk Management: Limiting the size of the active portion helps mitigate the risks associated with active investing. The passive core ensures your portfolio remains relatively stable, even if some active investments underperform.

Real-Life Examples of Blended Portfolios

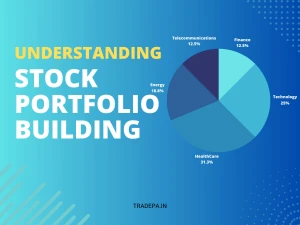

Consider a retirement portfolio as an example of a blended approach. The core might consist of index funds tracking broad market indexes like the NIFTY 50 and bond indexes, providing a mix of equity and fixed-income exposure. This core ensures the portfolio is diversified, cost-effective, and aligned with long-term growth objectives. The satellite portion could include a small allocation to individual stocks in high-growth sectors like technology or healthcare and actively managed mutual funds focusing on emerging markets or small-cap stocks.

Another example is a college savings fund. The core could be composed of passive ETFs tracking diversified equity and bond markets, ensuring steady growth and low fees. The satellite investments might include actively managed funds targeting specific educational trends or innovative companies in the education sector, aiming to boost returns over the savings period.

Conclusion

Selecting between active and passive investing is a crucial choice that depends on multiple factors, including financial goals, risk tolerance, and investment timeline. Active investing provides the opportunity for higher returns through market analysis and frequent trading, but it comes with increased risks and costs. In contrast, passive investing provides a more straightforward, cost-effective approach to replicate market performance, offering stability and lower fees.

A balanced approach that integrates both strategies may be the most effective for many investors. The core-satellite approach, for example, allows you to build a stable foundation with passive investments while using active investments to enhance returns and capitalize on market opportunities.

Ultimately, the best investment strategy aligns with your financial situation and objectives. Consistently reviewing and adjusting your portfolio ensures that it meets your needs as market conditions and your financial goals evolve.