How News Affects the Stock Market

Introduction

News and the stock market share a dynamic relationship, influencing each other significantly. Understanding this relationship is vital for traders looking to make well-informed decisions and navigate the volatility of the markets effectively.

The stock market and news relationship can be summarized as cause and effect. Whether related to economic indicators, corporate earnings, political developments, or global events, news catalyzes market movements. Positive news can increase stock prices, while negative news can lead to declines. The speed and magnitude of these market reactions often depend on the perceived significance of the news and its potential impact on different sectors and industries.

Traders must recognize that news doesn't just influence individual stocks; it can also impact broader market trends and investor sentiment. For example, the Federal Reserve's unexpected change in interest rates can trigger widespread market volatility, affecting interest-rate-sensitive sectors like banking and real estate and the overall market direction. Similarly, geopolitical tensions or trade disputes can cause market-wide fluctuations as investors react to the potential implications for global trade and economic growth.

Importance of Understanding News Impact on Stocks

For stock market traders, being aware of how news affects stock prices is essential for making informed trading decisions. Ignoring or underestimating the impact of news events can result in unforeseen losses or missed opportunities. By staying informed and analyzing news developments, traders can identify potential trading prospects, manage risk effectively, and adjust their techniques to meet the evolving demands of the market.

Moreover, understanding the nuances of news-driven market movements can help traders differentiate between short-term fluctuations and longer-term trends. While some news events may result in temporary price swings, others may signal broader market sentiment or fundamental shifts. By discerning the underlying drivers behind market movements, traders can better position themselves to capitalize on emerging trends and protect their portfolios from unnecessary risks.

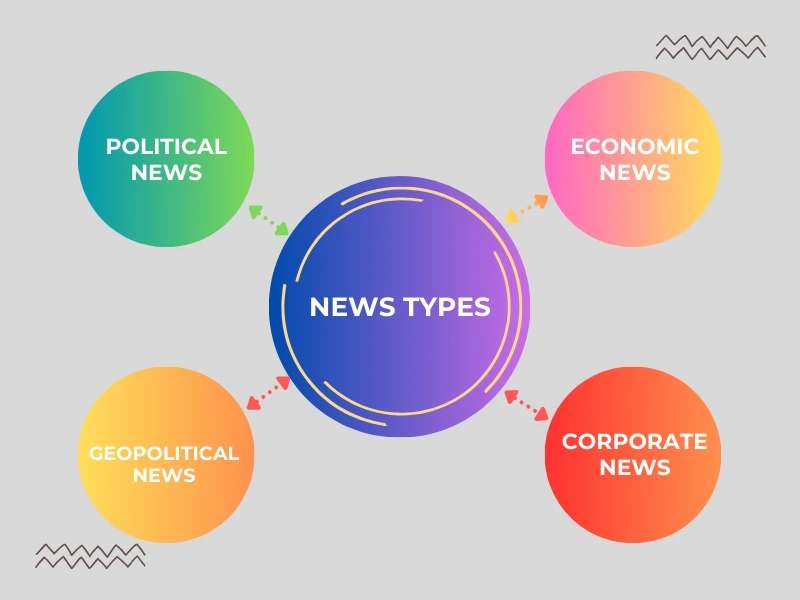

Types of News

News plays a key role in shaping the movements of the stock market. Understanding the different types of news and their implications is crucial for stock market traders looking to remain ahead of market trends and effectively make well-informed decisions. Several news categories can impact the stock market, each with its drivers and consequences.

Economic news

Economic news encompasses various indicators and data points that provide insights into the economy's health. Key economic indicators include:

- GDP (Gross Domestic Product) measures the overall economic output of a country.

- Unemployment rates indicate the health of the labor market.

- Interest rates, which influence borrowing costs and consumer spending.

Traders closely monitor economic news releases as they can significantly impact market sentiment and investor confidence.

Corporate news

It refers to developments related to individual companies, such as earnings reports, mergers, and acquisitions. Earnings reports, in particular, are closely watched by traders as they provide insights into a company's financial performance and prospects. Positive earnings surprises have the potential to trigger rallies in stock prices, while disappointing results can trigger sell-offs. Mergers and acquisition announcements can also impact stock prices, often involving significant corporate structure and market positioning changes.

Political news

Political news revolves around government actions, policies, and regulations that can affect businesses and industries. Elections, for example, can introduce uncertainty into the markets as investors assess the potential implications of different political outcomes. Government policy and regulation changes can also impact specific sectors and companies, leading to investor sentiment and market dynamics shifts.

Geopolitical news

Geopolitical news covers events and developments on the global stage, such as wars, conflicts, and trade agreements. Geopolitical tensions can create market volatility as investors respond to the potential impact on global trade, supply chains, and economic stability. Trade agreements and international relations can also influence market sentiment, particularly for companies with significant exposure to international markets. Traders must stay informed about geopolitical developments to anticipate potential risks and opportunities in the stock market.

Immediate Effects on Stock Prices

The reaction can be swift and significant when breaking news hits the market. Traders should be ready for sudden shifts in stock prices as market participants absorb and analyze new information. Understanding how markets react to breaking news is essential for traders aiming to seize on short-term trading opportunities.

1. Market Reaction to Breaking News

The market's reaction to breaking news can vary depending on the nature and perceived significance of the news. Positive news, such as better-than-expected earnings or favorable economic data, can lead to buying interest and upward price movements. Conversely, negative news, such as disappointing earnings or geopolitical tensions, can trigger selling pressure and downward price movements. Traders must quickly assess the potential impact of breaking news on specific stocks and sectors to take advantage of price movements.

A. Volatility Spikes

One of the immediate effects of breaking news is increased market volatility. Volatility spikes can occur as traders react to new information, leading to rapid price swings and heightened trading activity. For traders, understanding the factors driving volatility spikes is crucial for managing risk and seizing trading opportunities. By recognizing patterns in price movements and monitoring key indicators like the VIX (Volatility Index), traders can adapt their strategies to navigate volatile market conditions effectively.

B. The Role of Market Sentiment

Market sentiment significantly influences the immediate reaction to breaking news. Fear and greed dynamics can drive investor behavior, amplifying price movements and exacerbating market volatility. Traders must be mindful of the psychological factors influencing market sentiment and sentiment indicators such as investor surveys and sentiment indexes. By gauging market sentiment, traders can better anticipate the direction of price movements and modify their trading strategies accordingly.

2. Intraday Trading Opportunities

For traders focused on short-term gains, intraday trading opportunities abound in the wake of breaking news. Scalping strategies and day trading tactics offer avenues for capitalizing on short-term price movements driven by news events. By employing technical analysis and momentum trading techniques, traders can pinpoint suitable entry and exit points to exploit rapid price fluctuations and secure profits within a single trading session.

A. Scalping Strategies

Scalping is a short-term trading approach that aims to profit from small price movements. Traders employing scalping strategies capitalize on intraday price fluctuations, entering and exiting positions quickly to capture small gains. News-driven price movements provide ample opportunities for scalpers to execute rapid-fire trades, leveraging volatility to generate profits. However, scalping requires discipline and precision, as traders must act swiftly and decisively to capitalize on fleeting opportunities.

B. Day Trading Tactics

Day trading involves buying and selling financial instruments within a single trading day to profit from intraday price movements. News-driven trends can create favorable trading opportunities for day traders as market participants react to new information and adjust their positions accordingly. Day trading tactics such as trend following and breakout trading can be particularly effective in capturing momentum generated by news events. By staying agile and adaptable, day traders can take advantage of short-term trends and maximize their profits.

Analyzing News Sources

Traders rely heavily on news sources to make informed decisions in the stock market. Nevertheless, it's important to recognize that not all news sources hold the same level of credibility. It's essential for traders to critically evaluate the credibility of the sources they rely on to ensure they're getting accurate and reliable information.

1. Evaluating Credibility

As online news platforms and social media continue to expand, traders can access many news sources. While some outlets prioritize accuracy and impartiality, others may prioritize sensationalism or have vested interests that can bias their reporting. Traders should seek out reputable news sources known for their credibility and journalistic integrity. Established financial news outlets like Bloomberg, Reuters, and CNBC are typically reliable market news and analysis sources. By vetting the credibility of news outlets, traders can confidently make decisions backed by reliable information.

2. Insider Information

Traders must also consider legal and ethical considerations when obtaining and acting on insider information. Insider trading encompasses trading securities based on material, non-public information, is illegal, and can have severe legal consequences. Traders should avoid seeking or acting on insider information to secure an unfair advantage in the market. Instead, they should focus on analyzing publicly available information and conducting thorough research to inform their trading decisions. Upholding integrity and adhering to ethical standards is key for establishing trust and credibility as a trader.

3. Fact-Checking and Verifying News

In today's fast-paced news environment, misinformation and fake news are rampant. Traders must be vigilant about fact-checking and verifying the accuracy of news reports before acting on them. Cross-referencing information from multiple sources can help confirm its validity and identify discrepancies or inconsistencies. Traders should also be wary of rumors and unverified information circulating on social media platforms, as these sources may lack credibility or be intentionally misleading. By exercising due diligence and skepticism, traders can avoid falling victim to misinformation and make more informed trading decisions based on reliable sources of news and information.

Conclusion

In conclusion, the influence of news on stock markets is undeniable and ever-present. From economic indicators to corporate earnings reports, political developments, and geopolitical tensions, news events shape market sentiment and drive price movements daily. For stock market traders, understanding how news affects the markets is essential for making informed decisions and staying ahead of the curve.

In the dynamic and unpredictable world of stock market trading, news will continue to play a central role in influencing market dynamics and investor behavior. By recognizing the importance of news and its impact on stock markets, traders can navigate the complexities of the market with confidence and skill, ultimately positioning themselves for success in their trading endeavors.