Nifty and Bank Nifty Index Overview and Strategies

Introduction

In the Indian stock market, Nifty and BankNifty stand out as major indices that encapsulate the performance of specific segments. It is crucial to understand these indices' fundamental definitions and roles. Nifty, officially known as Nifty50, is a diversified index representing 50 large-cap stocks on India's National Stock Exchange (NSE). On the other hand, Bank Nifty is a specialized index focusing on banking and financial sector stocks. Both indices serve as vital barometers, offering investors a snapshot of the market's health and trends.

An Overview of Nifty and Bank Nifty

Nifty, or the National Stock Exchange Fifty, encompasses various sectors, broadly representing the Indian stock market. Comprising 50 blue-chip stocks, its calculation considers market capitalization, liquidity, and other factors. Nifty's counterpart, Bank Nifty, narrows its focus to the banking and financial sector. Understanding the composition and methodology behind these indices is pivotal for beginners. It lays the foundation for comprehending how market movements impact these indices and, consequently, investors' portfolios.

Significance of Indices in Financial Markets

Indices play a crucial role in the financial markets, acting as benchmarks that measure the overall performance of specific sectors or the market. For beginners, recognizing the significance of these indices is key to navigating the complexities of the stock market. Indices provide a reference point, helping investors assess the market's direction and make informed decisions. They serve as indicators of economic health, offering insights into the collective performance of stocks within a given sector. Understanding the role of indices is a stepping stone for beginners to engage with the broader financial landscape and make well-informed investment choices.

Understanding Nifty Index

It is a composite of 50 well-established and highly liquid stocks listed on the National Stock Exchange (NSE). These stocks are carefully selected to represent various sectors within the Indian economy. The composition of Nifty50 undergoes periodic reviews to ensure its relevance and accuracy. The methodology involves considering the free-float market capitalization of each stock, which means the total market value of its outstanding shares available for trading. By understanding the criteria for inclusion, beginners can grasp how Nifty50 reflects the performance of the market's blue-chip stocks.

List of Nifty 50 Companies

Here is the list of Nifty50 companies as on 15th of January, 2024.

| SYMBOL | NAME OF COMPANY |

| WIPRO | Wipro Limited |

| ONGC | Oil & Natural Gas Corporation Limited |

| HCLTECH | HCL Technologies Limited |

| TECHM | Tech Mahindra Limited |

| INFY | Infosys Limited |

| COALINDIA | Coal India Limited |

| DRREDDY | Dr. Reddy s Laboratories Limited |

| APOLLOHOSP | Apollo Hospitals Enterprise Limited |

| HDFCBANK | HDFC Bank Limited |

| RELIANCE | Reliance Industries Limited |

| ULTRACEMCO | UltraTech Cement Limited |

| SBIN | State Bank of India |

| BPCL | Bharat Petroleum Corporation Limited |

| CIPLA | Cipla Limited |

| BHARTIARTL | Bharti Airtel Limited |

| DIVISLAB | Divi s Laboratories Limited |

| KOTAKBANK | Kotak Mahindra Bank Limited |

| TITAN | Titan Company Limited |

| LTIM | LTIMindtree Limited |

| UPL | UPL Limited |

| INDUSINDBK | IndusInd Bank Limited |

| BAJAJ-AUTO | Bajaj Auto Limited |

| SUNPHARMA | Sun Pharmaceutical Industries Limited |

| NTPC | NTPC Limited |

| TCS | Tata Consultancy Services Limited |

| ICICIBANK | ICICI Bank Limited |

| BRITANNIA | Britannia Industries Limited |

| POWERGRID | Power Grid Corporation of India Limited |

| MARUTI | Maruti Suzuki India Limited |

| ITC | ITC Limited |

| NESTLEIND | Nestle India Limited |

| HINDUNILVR | Hindustan Unilever Limited |

| M&M | Mahindra & Mahindra Limited |

| JSWSTEEL | JSW Steel Limited |

| AXISBANK | Axis Bank Limited |

| ADANIENT | Adani Enterprises Limited |

| ADANIPORTS | Adani Ports and Special Economic Zone Limited |

| TATASTEEL | Tata Steel Limited |

| LT | Larsen & Toubro Limited |

| ASIANPAINT | Asian Paints Limited |

| HEROMOTOCO | Hero MotoCorp Limited |

| SBILIFE | SBI Life Insurance Company Limited |

| TATAMOTORS | Tata Motors Limited |

| GRASIM | Grasim Industries Limited |

| BAJAJFINSV | Bajaj Finserv Limited |

| EICHERMOT | Eicher Motors Limited |

| HINDALCO | Hindalco Industries Limited |

| BAJFINANCE | Bajaj Finance Limited |

| TATACONSUM | TATA CONSUMER PRODUCTS LIMITED |

| HDFCLIFE | HDFC Life Insurance Company Limited |

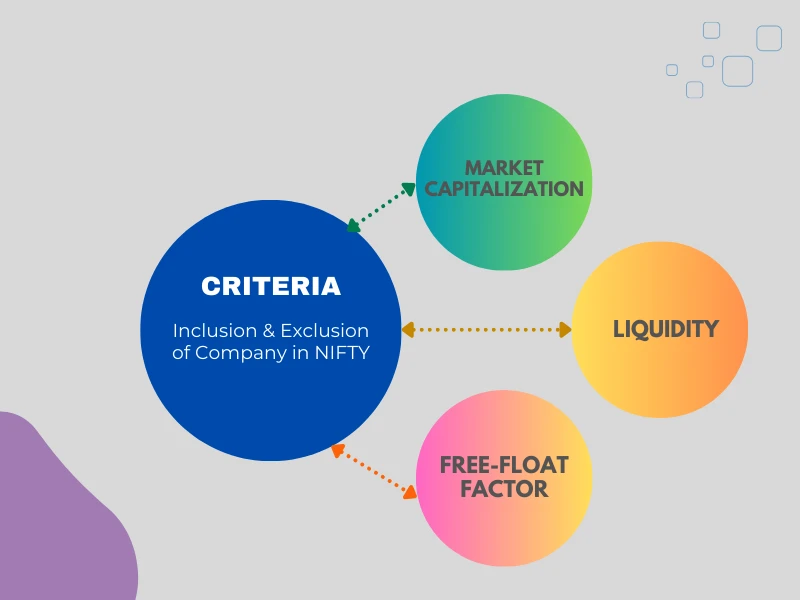

Criteria for Inclusion and Exclusion of Companies in Nifty

- Market Capitalization: To be included in Nifty, a company must have a minimum market capitalization that places it among the top stocks listed on the National Stock Exchange (NSE). This criterion ensures that the index comprises significant and actively traded companies.

- Liquidity: Stocks included in Nifty must have sufficient liquidity, meaning that their shares are actively traded in the market. This criterion ensures that investors can easily buy or sell shares without significantly impacting the stock's price.

- Free-Float Factor: The free-float factor, representing the proportion of shares available for trading, is a crucial criterion. Companies with a higher free-float factor are given more weight in the index, ensuring that the index accurately reflects the market.

How Nifty is Calculated

- Market Capitalization-Weighted: Nifty follows a market capitalization-weighted methodology. This means that the stocks within the index are assigned weights based on their respective market capitalization, which is the total market value of their outstanding shares. Larger companies within it influence the index more significantly.

- Free-Float Methodology: The index employs the free-float market capitalization methodology. It considers only the freely tradable shares of a company, excluding those held by promoters, governments, or other entities that might restrict trading. This methodology ensures a more precise representation of the market.

- Sectoral Representation: Nifty aims for a balanced representation of various sectors in the Indian economy. The selection of 50 stocks considers the diversity of industries, ensuring that the index reflects the overall market sentiment rather than being skewed toward specific sectors.

Nifty Rebalancing

- Periodic Reviews: Nifty undergoes periodic reviews, typically semi-annually, to ensure its relevance and accuracy. These reviews involve assessing the performance and market capitalization of the existing constituents, considering changes in the economic landscape and corporate world.

- Additions and Deletions: Companies may be added to or removed from Nifty based on the reviews. This process allows the index to adapt to the evolving market conditions and ensures that it continues to represent the current state of the Indian stock market.

- Weight Adjustments: As stock prices fluctuate, the weights of individual stocks in Nifty may change. The periodic rebalancing process involves adjusting these weights to maintain the desired market capitalization-weighted structure.

Nifty Sectoral Indices

Beyond the Nifty50, the NSE features a range of sectoral indices that cater to specific industries. These sectoral indices, such as NiftyBank, Nifty IT, Nifty Pharma, etc., focus on particular sectors, allowing investors to gauge the performance of industries individually. Exploring these diverse components gives beginners insights into how different economic sectors contribute to the overall market trends. Whether it's technology, finance, or healthcare, each sectoral index has its unique set of constituent stocks, influencing the overall dynamics of the market.

Nifty's Impact on Investor Portfolios

It serves as a benchmark against which the performance of individual stocks and mutual funds is often measured. When Nifty rises or falls, it reflects broader market trends, affecting the valuation of various investments. As a result, tracking Nifty's movements helps investors make informed decisions, whether adjusting their portfolio allocations or identifying potential opportunities during market shifts. Learning to interpret Nifty's impact equips beginners with a valuable tool for managing and optimizing their investment portfolios in line with market trends.

Exploring the Bank Nifty Index

BankNifty, a derivative of the Nifty index, is a specialized index that revolves around the banking and financial sector in India. Comprising major banking stocks listed on the NSE, Bank Nifty is a distinctive indicator of this crucial segment's financial health and stability. For beginners, delving into Bank Nifty offers an opportunity to gain insights into the performance of key players shaping the country's economic backbone.

Bank Nifty Constituents

Exploring the constituents that make up this specialized index is essential to comprehend Bank Nifty's influence. Major banking institutions, both public and private, contribute to the composition of Bank Nifty. Analyzing these key players provides beginners with a deeper understanding of the dynamics within the financial sector. As these constituent stocks represent the pillars of the banking industry, their performance collectively influences the movements of Bank Nifty, offering a nuanced perspective for investors seeking exposure to financial markets.

List of NIFTY BANK Companies

Here is the list of NIFTYBANK companies as on 15th of January, 2024.

| SYMBOL | NAME OF COMPANY |

| HDFCBANK | HDFC Bank Limited |

| SBIN | State Bank of India |

| KOTAKBANK | Kotak Mahindra Bank Limited |

| INDUSINDBK | IndusInd Bank Limited |

| PNB | Punjab National Bank |

| BANKBARODA | Bank of Baroda |

| ICICIBANK | ICICI Bank Limited |

| FEDERALBNK | The Federal Bank Limited |

| BANDHANBNK | Bandhan Bank Limited |

| AXISBANK | Axis Bank Limited |

| IDFCFIRSTB | IDFC First Bank Limited |

| AUBANK | AU Small Finance Bank Limited |

Linking Bank Nifty Movements to Economic Indicators

Understanding the movements of Bank Nifty goes beyond the stock market; it extends to the broader economic landscape. Bank Nifty is intricately linked to various economic indicators, acting as a barometer for the nation's financial health. Interest rates, inflation, and monetary policy changes directly impact banking stocks, influencing Bank Nifty's trajectory. For beginners, recognizing these connections provides a valuable framework for interpreting market movements and anticipating shifts in the economic environment. As Bank Nifty responds to changes in economic indicators, investors can gain insights into potential opportunities and risks within the financial sector.

Comparative Analysis of Nifty and Bank Nifty

| Aspect | Nifty | Bank Nifty |

|---|---|---|

| Composition | Diverse, comprising 50 blue-chip stocks across various sectors | Specialized, focused exclusively on banking and financial stocks |

| Representation | Represents the overall market sentiment | Reflects the performance of the financial sector |

| Sensitivity to Economic Factors | Moderately influenced by economic indicators and various sectors | Highly sensitive to changes in economic indicators related to banking and finance |

| Risk Exposure | Offers a more balanced risk exposure due to diversification | Exhibits higher risk exposure, particularly linked to financial sector risks |

| Historical Performance Patterns | Historical trends influenced by the overall economic climate | Historical trends closely aligned with banking and financial sector conditions |

| Diversification Potential | Provides diversification across multiple sectors | Offers sector-specific diversification, especially in financial markets |

| Investor Preference | Attracts a broader range of investors seeking diversified exposure | Attracts investors with a specific interest in the banking and financial sector |

| Benchmark Role | Widely used as a benchmark for various financial products and mutual funds | Serves as a benchmark for financial products focused on banking stocks |

Nifty and BankNifty, though both integral to the Indian stock market, exhibit distinct characteristics due to their unique compositions. While Nifty50 encompasses a diversified range of sectors, Bank Nifty narrows its focus exclusively to banking and financial stocks. Understanding these distinctions is crucial for investors. Nifty represents the broader market sentiment, influenced by various economic factors, while Bank Nifty is more sensitive to changes in the financial sector. Beginners can navigate the market more effectively by comprehending the nuanced differences in these indices.

Examining the historical performance of Nifty and BankNifty unveils valuable insights into their behavior during different market conditions. Historical trends and patterns can provide beginners a roadmap for anticipating potential movements. Investors can identify recurring patterns by studying past performances, helping them make informed decisions during similar market scenarios. Analyzing the historical data of Nifty and Bank Nifty side by side allows beginners to understand how these indices have responded to economic changes, crises, and periods of growth.

Trading and Investment Strategies

Nifty Trading Strategies for Beginners

- Long-Term Investing: Beginners can adopt a long-term investment strategy for Nifty, focusing on buying and holding assets over an extended period. This approach aligns with the market's growth, enabling investors to leverage the compounding effect for potential benefits.

- Active Trading: For those seeking more immediate returns, active trading strategies such as intraday trading or swing trading can be explored. Day trading involves making multiple trades within a single day, while swing trading aims to capture short to medium-term price movements. Both require a hands-on approach and a good understanding of market trends.

- Technical Analysis: Learning the basics of technical analysis is crucial for Nifty traders. This involves studying chart patterns, indicators, and other statistical measures to predict future price movements. It helps traders in making well-informed decisions based on historical market data.

- Market Awareness: Staying informed about economic indicators and corporate news is essential. Economic indicators, including GDP growth, inflation rates, and employment figures, can impact overall market sentiment and Nifty's performance. Corporate news, such as earnings reports and major announcements, can influence individual stock prices within the index.

Bank Nifty Investment Approaches

- Fundamental Analysis: Beginners investing in Bank Nifty can benefit from fundamental analysis. This involves evaluating the financial health of key banking institutions within the index. Factors such as revenue, earnings, and debt levels are essential metrics to consider.

- Economic Factors: Understanding broader economic factors influencing the banking sector is crucial. Interest rates, regulatory changes, and macroeconomic trends can significantly impact the performance of banking stocks within BankNifty.

- Investment Horizon: Investors in BankNifty should decide on their investment horizon. Long-term investors may choose to hold onto banking stocks for an extended period. At the same time, those seeking short-term gains might explore opportunities aligned with specific economic events or policy changes.

- Policy Impact: Stay informed about government fiscal policies that can impact the banking sector. Changes in regulations, monetary policies, and government initiatives can significantly affect Bank Nifty's performance.

Navigating Market Volatility

- Diversification: Diversifying across various sectors is a risk management strategy for Nifty and Bank Nifty investors. Spreading investments reduces the impact of poor performance in any single sector.

- Stop-Loss Orders: Implementing stop-loss orders is a risk mitigation tactic. This involves setting predetermined levels to sell an asset, protecting investors from substantial losses during unpredictable market swings.

- Stay Informed: Regularly monitoring sector-specific news is essential for BankNifty investors. For Nifty investors, staying informed about broader economic indicators, market trends, and global events is crucial for making well-timed investment decisions.

- Options and Derivatives: Understanding and utilizing options and derivatives can provide additional tools for risk management. Investors can utilize these financial instruments to safeguard against potential losses and capitalize on market fluctuations through hedging strategies. However, beginners should approach these tools cautiously and seek professional advice if necessary.

Global Perspectives

How Nifty and Bank Nifty Compare on the Global Stage

Nifty's Global Presence: While primarily serving as an indicator of the Indian stock market, Nifty has gained international recognition. Global investors often monitor Nifty's performance as part of their broader investment strategies, considering it a representative gauge of the Indian economic landscape. The diverse sectors within Nifty make it an appealing benchmark for those looking to diversify their global portfolios.

Bank Nifty's Sector-Specific Appeal: Bank Nifty, focusing on the banking and financial sector, attracts specific attention on the global stage. Investors interested in the global financial market may use Bank Nifty as an indicator of the health and performance of the Indian banking industry. Its sector-specific nature can offer insights into India's financial stability, making it a unique component for international investors.

Impact of Global Factors on Indian Indices

Economic Globalization: Both Nifty and BankNifty are susceptible to the influences of global economic factors. Economic globalization means that events in major international markets can have a cascading impact on the Indian economy and, consequently, on these indices. Changes in global interest rates, trade policies, and geopolitical events can reverberate through the Indian stock market.

Currency Exchange Rates: The performance of Nifty and BankNifty may be affected by fluctuations in currency exchange rates. International investors may adjust their holdings based on currency movements, affecting the valuation of stocks within these indices. Understanding the interconnectedness of global currencies is essential for investors looking to navigate the complexities of the Indian market.

Exploring Opportunities for Global Investors in Nifty and Bank Nifty

Diversification Benefits: Nifty and BankNifty offer global investors an opportunity to diversify their portfolios. Investing in these indices allows for exposure to the Indian market, which operates independently of other major global markets. This diversification strategy can provide a hedge against risks associated with regional economic downturns or uncertainties.

Strategic Portfolio Allocation: Global investors looking to capitalize on India's economic growth may strategically allocate funds to Nifty and BankNifty. Understanding the performance drivers of these indices and their responsiveness to global and domestic factors is crucial for making informed investment decisions.

Access through Global Investment Platforms: Many international investment platforms facilitate access to Indian indices, providing global investors with the means to trade Nifty and BankNifty. As these indices gain popularity, more avenues for global participation emerge, making it easier for investors worldwide to explore opportunities in the dynamic Indian market.

Risk Management

Market Fluctuations: Nifty and Bank Nifty, like any financial instruments, are susceptible to market fluctuations. Rapid price shifts can occur due to factors such as geopolitical events, economic indicators, or changes in investor sentiment. Understanding the inherent volatility in these indices is crucial for investors to navigate and manage risks effectively.

External Factors: Risks in Nifty and Bank Nifty are often influenced by external factors beyond market dynamics. Economic policies, global events, and unforeseen crises can impact these indices. Investors need to stay informed about macroeconomic trends and external factors that could trigger shifts in market sentiment and affect the performance of Nifty and BankNifty.

Hedging Strategies

Options Trading for Hedging: Options trading provides investors a powerful tool for hedging against potential losses in Nifty and BankNifty. Put options, for instance, allow investors to protect their portfolios by providing the right to sell at a predetermined price, acting as a safeguard during market downturns.

Diversification as a Hedging Tool: Diversifying investments across different sectors and asset classes is a fundamental risk mitigation strategy. By spreading investments, investors can reduce the impact of poor performance in any single sector, providing a level of protection against volatility in Nifty and BankNifty.

Tips for Safeguarding Your Portfolio

- Set Clear Investment Goals: Defining investment goals is the first step toward risk-aware investing. Whether seeking long-term growth or short-term gains, having a well-defined investment strategy aligns decisions with specific objectives, minimizing impulsive actions driven by market fluctuations.

- Regular Portfolio Assessment: Periodic portfolio assessments help investors identify and address risks promptly. Regularly reviewing the performance of Nifty and BankNifty components and the overall portfolio ensures that investments align with evolving market conditions and individual risk tolerance.

- Emergency Fund Allocation: Setting aside funds for emergencies or unforeseen market downturns is a prudent risk management practice. A reserve allows investors to navigate challenging periods without liquidating investments at unfavorable prices.

- Stay Informed and Seek Professional Advice: Staying informed about market trends, economic indicators, and changes in regulatory environments is essential. Furthermore, consulting with financial professionals can provide valuable insights and guidance, especially during heightened market uncertainty.

Conclusion

Nifty's diverse composition across sectors serves as a broad indicator of the Indian stock market. Focusing on the financial sector, Bank Nifty provides insights into the performance of pivotal players in the banking industry. Beginners should recognize the unique characteristics of each index.

Both indices offer a spectrum of investment opportunities. Understanding their historical performance, sectoral influences, and the impact of global factors allows beginners to make informed decisions that aligned with their investment goals and risk tolerance.

Integrating Nifty and BankNifty into an investment portfolio enhances diversification. The combination of a broad-market indicator (Nifty) and a sector-specific index (Bank Nifty) provides investors with exposure to different facets of the Indian economy, helping to mitigate risks associated with specific sectors.

The lessons learned from understanding risks in Nifty and BankNifty can be applied to building a robust investment portfolio. Implementing risk management strategies, like hedging and diversification, contributes to the overall resilience of the portfolio.

As both indices gain international recognition, the global integration of Nifty and BankNifty is expected to increase. Global investors may continue to explore opportunities in these indices, contributing to their relevance on the international stage.

Anticipating developments in Nifty and BankNifty requires understanding ongoing market dynamics. Staying informed about changes in economic policies, regulatory environments, and global economic trends positions investors to adapt their strategies to evolving market conditions.

In conclusion, beginners in Nifty and BankNifty should view these indices as market performance indicators and valuable tools for informed decision-making. Investors can confidently navigate the stock market's complexities by incorporating key takeaways, building diversified portfolios, and staying attuned to future trends.