How Dow Jones Futures Influence the Indian Stock Market

In the fast-paced world of finance, navigating markets can be both thrilling and challenging. One avenue that often captures the attention of investors seeking maximum returns is Dow Jones Futures. These financial instruments provide a unique gateway to the future movements of the stock market, presenting both opportunities and risks. In this article, we will embark on a journey to understand Dow Jones Futures comprehensively, exploring their significance in the investment landscape and uncovering the reasons why investors are increasingly drawn to them.

Dow Jones Future are financial contracts that derive their value from the anticipated future performance of the Dow Jones Industrial Average (DJIA). The DJIA, comprising 30 major companies, serves as a barometer for the broader stock market. Futures contracts allow investors to speculate on the future direction of the DJIA, whether they anticipate a rise or fall in its value. This ability to speculate on market movements before they occur is one of the primary reasons why Dow Jones Futures hold such significance in the financial world.

Why Investors are Drawn to Dow Jones Futures

Investors are naturally attracted to Dow Jones Futures for several compelling reasons. Firstly, these instruments offer a way to hedge against market volatility. In uncertain times, having the ability to offset potential losses in traditional investments can provide a sense of security. Secondly, Dow Jones Futures provide an avenue for speculative trading. Investors can capitalize on both rising and falling markets, potentially profiting from market fluctuations. Lastly, the leverage available in futures trading allows investors to control a large position with a relatively small amount of capital, amplifying both gains and losses.

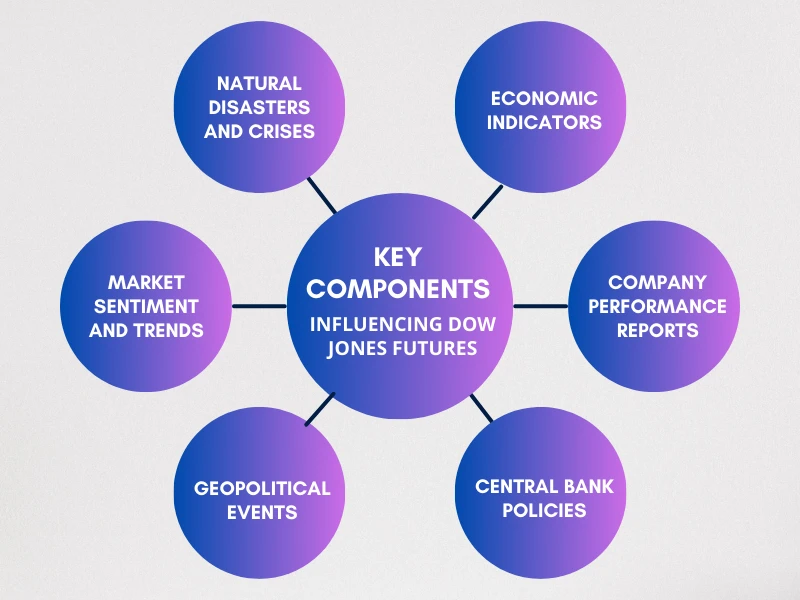

Key Components Influencing Dow Jones Futures

Understanding Dow Jones Futures involves recognizing the key components that influence their movements. It is an essential step for those looking to navigate the complexities of Dow Jones Futures for maximum returns.

- Economic Indicators: Indicators such as GDP, employment reports, and inflation can impact the overall market sentiment.

- Company Performance Reports: The financial health and performance of the companies represented in the DJIA play a crucial role in shaping Dow Jones Futures.

- Central Bank Policies: Decisions made by central banks, including interest rate changes and monetary policy adjustments, have a direct impact on market liquidity and investor behavior.

- Geopolitical Events: Global events, political developments, and trade relations can create volatility and influence market movements.

- Market Sentiment and Trends: Analyzing historical data and monitoring current market conditions help identify potential opportunities and risks when trading Dow Jones Futures.

- Natural Disasters and Crises: Unforeseen events, such as natural disasters or unexpected crises, can create volatility in financial markets. Investors often react to these events, affecting market sentiment.

Analyzing Market Trends Impacting Dow Jones Futures

- Technical Analysis: Utilizing technical analysis tools helps investors evaluate historical price data, identify patterns, and make predictions about future price movements. Chart patterns, support and resistance levels, and various technical indicators play a crucial role in analyzing market trends related to Dow Jones Futures.

- Fundamental Analysis: Examining the fundamental aspects of the market involves assessing economic indicators, company earnings reports, and other financial metrics. Fundamental analysis provides a broader understanding of the underlying factors that may influence the DJIA and subsequently impact Dow Jones Futures.

- Sentiment Analysis: Market sentiment, driven by investor emotions and perceptions, can significantly impact Dow Jones Futures. Monitoring news, social media, and expert opinions helps gauge the prevailing sentiment in the market, providing valuable information for making informed trading decisions.

How Dow Jones Futures affects Indian Stock market

The Dow Jones Futures can influence the Indian stock market, but the relationship is complex and influenced by various factors. Here are some ways in which Dow Jones Futures can impact the Indian stock market:

1. Global Market Sentiment:

As a major index in the United States, Dow Jones Futures significantly influences global financial markets. Due to its prominence and extensive coverage in financial media, movements in the Dow Jones Futures often serve as a barometer for investor sentiment worldwide. Investors and analysts closely monitor changes in the Dow Jones Futures as they provide valuable insights into the broader health of the U.S. economy and, by extension, global economic conditions.

When the Dow Jones Futures exhibit positive movements, it tends to signal optimism and confidence among investors. This optimism often extends beyond U.S. borders, influencing investor sentiment in other markets, including emerging economies like India. Conversely, adverse movements in the Dow Jones Futures can trigger concerns and uncertainty among investors globally, leading to risk aversion and potential sell-offs in various financial markets.

2. Foreign Institutional Investment (FII) Flows:

The performance of major global indices, including the Dow Jones, plays a significant role in shaping the investment decisions of FIIs in the Indian stock market. As FIIs account for a substantial portion of trading activity and capital inflows, their actions can have a profound impact on market liquidity, asset prices, and overall market sentiment in India.

3. Currency Movements:

Currency movements play a crucial role in the relationship between Dow Jones Futures and the Indian stock market, as they directly impact the profitability of foreign investments in India and influence investor behavior.

When the Dow Jones Futures indicate positive movements, signaling optimism and confidence among investors, it often leads to an appreciation of the USD. Conversely, negative trends in Dow Jones Futures may result in a depreciation of the USD.

A strengthening U.S. dollar may lead to outflows from emerging markets, including India.

4. Commodity Prices:

Dow Jones Futures movements can influence global commodity prices, which, in turn, can affect sectors in the Indian stock market. For example, a decline in Dow Jones Futures may lead to a decrease in demand for commodities, impacting industries like metals and mining in India.

5. Risk Appetite:

Dow Jones Futures trends can impact investor risk appetite globally. During periods of heightened volatility or economic uncertainty, investors may seek safer assets, potentially impacting capital flows in and out of India.

6. Interest Rates and Inflation:

Changes in Dow Jones Futures can influence global interest rates and inflation expectations. Any resulting changes in international interest rates may impact capital flows into Indian markets, especially impacting interest-sensitive sectors like banking.

It's important to note that while there can be correlations and influences, the Indian stock market is also affected by domestic factors, government policies, economic indicators, and corporate performance. Investors and traders should consider a holistic approach, taking into account both global and local factors when making investment decisions in the Indian stock market. Additionally, past correlations may not always predict future movements, and markets can react differently based on changing economic conditions.

Conclusion

In conclusion, the Dow Jones Futures serve as a critical barometer of global market sentiment, with movements in the index influencing investor behavior and market dynamics worldwide. The performance of Dow Jones Futures can impact the Indian stock market in several ways, including influencing foreign institutional investment flows, currency movements, commodity prices, global interest rates, and inflation expectations. Positive trends in Dow Jones Futures often signal optimism among investors, leading to increased investment in the Indian stock market, while adverse movements may prompt risk aversion and capital outflows. Therefore, understanding the relationship between Dow Jones Futures and the Indian stock market is essential for investors and policymakers to navigate market trends, manage risks, and make informed investment decisions.